Fixer-Upper Homes – A Guide To Getting The Best Deal

Deal with the potential pitfalls and hidden treasures of fixer-upper homes by arming yourself with knowledge. Fixer-upper homes can be an excellent investment opportunity, but without careful consideration, they can quickly turn into a money pit. In this comprehensive guide, we will explore the benefits and risks of buying a fixer-upper, provide expert tips on how to spot a diamond in the rough, and offer strategies for negotiating the best deal. Whether you’re a first-time homebuyer looking to make your budget stretch or an experienced investor seeking to maximize your ROI, this guide will empower you to make informed decisions and secure the best possible outcome in your fixer-upper home purchase.

Key Takeaways:

- Thorough Inspection is Essential: Before purchasing a fixer-upper, it is crucial to conduct a thorough inspection to identify any structural or foundational issues that may require expensive repairs.

- Consider Hidden Costs: Factor in the cost of renovations, permits, and unexpected expenses when determining the true cost of buying a fixer-upper. Be prepared for the financial commitment involved in bringing the property up to standard.

- Strategic Negotiation is Key: Use the information from the inspection to negotiate a lower purchase price with the seller. Understand the market value of homes in the area to ensure you are getting the best deal possible on your fixer-upper.

Types of Fixer-Upper Homes

Even the most seasoned homebuyer can be overwhelmed by the variety of fixer-upper homes on the market. Understanding the different types of properties available can help you make an informed decision and find the best deal for your investment.

| Cosmetic Fixer-Uppers Structural Fixer-Uppers Full Renovation Projects | Historic Homes Foreclosed Properties Distressed Sales |

Cosmetic Fixer-Uppers

Cosmetic fixer-uppers are properties that require mostly surface-level improvements. This could include updating paint, flooring, light fixtures, and landscaping. While these homes may appear dated, the issues are generally cosmetic and can be easily addressed with some elbow grease and a modest budget.

For buyers looking for a quick turnaround and a more manageable project, cosmetic fixer-uppers can be an attractive option. With some minor upgrades, these homes can be transformed into a modern living space without breaking the bank.

Structural Fixer-Uppers

An entirely different ball game, structural fixer-uppers require more than just cosmetic touch-ups. These properties have significant issues with the foundation, roof, plumbing, or electrical systems that need to be addressed by professionals. While the cost of repairs may be higher, the potential return on investment can also be substantial.

With structural fixer-uppers, it’s crucial to enlist the help of experienced contractors and inspectors to assess the extent of the damages and provide estimates for the necessary repairs. Any buyer considering this type of project should be prepared for a longer renovation timeline and a larger financial investment.

With structural fixer-uppers, the key is to prioritize safety and structural integrity over aesthetics. Addressing these issues upfront can prevent more significant problems down the line and ensure a sound investment in the long run.

Full Renovation Projects

Embarking on a full renovation project means taking on a property that requires extensive work from top to bottom. These homes often need everything from a new roof and HVAC system to updated plumbing and electrical wiring. While the scope of these projects can be daunting, the potential to create your dream home is limitless.

Plus, full renovation projects offer the opportunity to customize every detail of your home to suit your taste and lifestyle. While the costs and time commitment may be higher, the end result can be incredibly rewarding for those willing to put in the effort.

Steps to Getting the Best Deal

Once again, buying a fixer-upper home can be a rewarding investment if you follow the right steps. In this guide, we will discuss the crucial steps to getting the best deal on a fixer-upper property.

Step-by-Step Approach to Finding the Right Property

Steps

| Step 1: Research | Start by researching neighborhoods and property listings to identify potential fixer-upper homes. |

| Step 2: Set a Budget | Determine a realistic budget that includes not only the purchase price but also renovation costs. |

| Step 3: Hire a Real Estate Agent | Work with a real estate agent who specializes in fixer-upper properties to help you find the right home. |

Inspecting Potential Homes – What to Look For

Getting a fixer-upper inspected is a crucial step in the buying process. What you need to look for during an inspection includes:

Inspect the foundation, roof, plumbing, and electrical systems for any major issues. Look for signs of water damage, mold, and pest infestations. Consider the overall condition of the home and the extent of renovations required.

Negotiating the Purchase Price

Best negotiation strategies can help you secure the best deal on a fixer-upper property. Be prepared to:

Negotiate based on the inspection report and estimates for necessary repairs. Consider the market conditions and the seller’s motivation to gauge the flexibility in the asking price. Be willing to walk away if the terms are not favorable to you.

Factors to Consider Before Buying

For potential buyers looking at fixer-upper homes, there are several factors to consider before making a purchase. Taking the time to evaluate these key aspects can help you make an informed decision and ensure that you get the best deal possible.

- Estimating Renovation Costs: Before exploring into a fixer-upper property, it’s crucial to assess the potential renovation costs involved. This includes getting quotes from contractors, factoring in materials, and leaving room for unexpected expenses. Having a clear idea of the financial commitment required will help you determine if the project is feasible.

- Evaluating the Location and Neighborhood: For fixer-upper homes, the location plays a significant role in the overall value of the property. Research the neighborhood, nearby amenities, schools, and potential for appreciation. A desirable location can often outweigh the challenges of a property in need of renovations.

Estimating Renovation Costs

Before launching on a fixer-upper project, it is vital to have a clear understanding of the potential costs involved. Obtaining accurate estimates from contractors and building in a contingency fund for unexpected expenses is crucial. Knowing the extent of the renovations needed and their associated costs will help you budget effectively and avoid financial surprises.

Evaluating the Location and Neighborhood

For those considering a fixer-upper, evaluating the location and neighborhood is paramount. A property’s value and potential for appreciation are heavily influenced by its surroundings. Factors such as proximity to amenities, schools, and shopping centers can significantly impact the resale value and overall investment potential. Perceiving the neighborhood trends and growth patterns can give you insight into the property’s long-term value.

Considering the Timeline for Renovations

To ensure a successful fixer-upper purchase, it’s crucial to consider the timeline for renovations. Assessing the extent of work needed and setting realistic expectations for completion can help you avoid delays and cost overruns. For instance, working with contractors to establish a scheduled timeline and setting milestones for progress can keep the project on track and within budget.

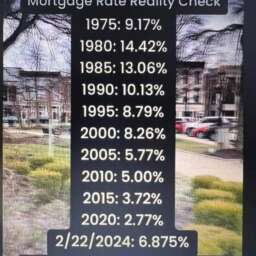

Understanding Financing Options

Location plays a vital role in the financing options available for a fixer-upper purchase. Factors such as property condition, neighborhood desirability, and potential appraisal value can affect loan approval and terms. Considering different financing options, such as renovation loans or HELOCs, can provide flexibility in funding the renovation project. Partnering with a lender who understands the unique challenges of fixer-upper properties can help you navigate the financing process.

Pros and Cons of Fixer-Uppers

Unlike turnkey homes, fixer-uppers offer both advantages and potential pitfalls for buyers to consider. It’s important to weigh these factors carefully before entering into a fixer-upper project.

| Pros | Cons |

| Lower purchase price | Unforeseen repair costs |

| Opportunity to customize and add value | Time-intensive renovations |

| Potential for higher return on investment | Risk of going over budget |

| Ability to build sweat equity | Challenges in securing financing |

| Flexibility in renovation choices | Potential for hidden structural issues |

Advantages of Investing in Fixer-Uppers

Pros: One of the significant benefits of buying a fixer-upper is the lower purchase price compared to turnkey homes. This initial cost savings can free up funds for renovations and upgrades, allowing buyers to customize the property to their preferences. Additionally, investing in a fixer-upper provides the opportunity to build sweat equity and potentially see a higher return on investment over time.

Pros: Another advantage is the flexibility in renovation choices. Buyers can tailor the upgrades to suit their needs and design preferences, creating a personalized space that aligns with their vision for their dream home. This creative control can be highly rewarding for those who enjoy hands-on projects and have a keen eye for design.

Potential Pitfalls and How to Avoid Them

Avoid: While fixer-uppers offer many advantages, there are also potential pitfalls to consider. Unforeseen repair costs are a common concern, as renovations can uncover hidden issues that were not apparent during the initial inspection. To mitigate this risk, it’s crucial to conduct a thorough home inspection before purchasing a fixer-upper and budgeting for contingencies.

Pitfalls: In addition to unforeseen repair costs, time-intensive renovations can also pose challenges for fixer-upper buyers. It’s important to have a realistic timeline in place and be prepared for unexpected delays that may arise during the renovation process. Proper planning and working with experienced contractors can help streamline the renovation timeline and ensure a successful outcome.

Tips for Fixer-Upper Success

Despite the challenges, purchasing a fixer-upper home can be a rewarding investment. With the right approach, you can transform a neglected property into your dream home while adding value. Here are some necessary tips to help you achieve fixer-upper success:

Assembling a Reliable Renovation Team

Tips for assembling a reliable renovation team include hiring experienced professionals who specialize in home renovations. Look for contractors, plumbers, electricians, and designers with a proven track record of delivering high-quality work within budget and on schedule. It’s crucial to communicate your vision clearly and listen to their expert advice to ensure a successful outcome.

Creative Ideas for Cost-Effective Renovations

One key strategy for cost-effective renovations is to focus on cosmetic improvements that make a big impact without breaking the bank. Consider painting walls, updating fixtures, and refinishing floors to give the space a fresh look. For more extensive renovations, explore DIY options for tasks like landscaping, tiling, or simple carpentry work to save on labor costs.

For instance, you can repurpose old furniture or reclaimed materials to create unique pieces that add character to your home without the hefty price tag. By thinking outside the box and being resourceful, you can achieve a stylish and personalized look while staying within budget.

Staying Organized and on Budget

Creative budgeting is necessary for staying on track during a fixer-upper renovation. Keep detailed records of all expenses and prioritize spending on critical structural repairs to ensure the home is safe and up to code. Create a realistic timeline for the renovation process and allow for unexpected costs by setting aside a contingency fund.

Staying disciplined with your budget and timeline will help prevent costly delays and overruns. Regularly review your progress and make adjustments as needed to stay on course. By staying organized and proactive, you can successfully complete your fixer-upper project within your financial means.

Summing up

Taking this into account, buying a fixer-upper home can be a rewarding and cost-effective investment if approached with the right knowledge and strategy. By understanding the potential pitfalls and benefits of purchasing a home in need of repair, buyers can confidently navigate the real estate market to secure the best deal possible. With thorough research, careful budgeting, and a realistic renovation plan in place, buyers can turn a fixer-upper into their dream home while adding value to their investment. Note, patience and diligence are key when looking for the perfect fixer-upper property that aligns with your vision and budget.

FAQ

Q: What are fixer-upper homes?

A: Fixer-upper homes are properties that require substantial repairs or renovations in order to become livable or increase their market value.

Q: How can buyers benefit from purchasing a fixer-upper home?

A: Buyers can benefit from purchasing a fixer-upper home by acquiring the property at a lower price, customizing it to their preferences, and potentially increasing its value through renovations.

Q: What should buyers consider before purchasing a fixer-upper home?

A: Before purchasing a fixer-upper home, buyers should consider their budget for renovations, the extent of repairs needed, local zoning laws and regulations, and the potential return on investment from the property.

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇