10 Essential Things To Know About Buying a Home

Embarking on the journey to homeownership is as exhilarating as it is intricate. With a blend of excitement and the gravity of making one of life’s largest investments, the process demands careful consideration. Our guide, tailored just for you – the first-time homebuyer, the aspiring homeowner – delivers commanding knowledge to navigate the complex terrain of the real estate market. Glean insights from an authoritative source that prides itself on empowering you with all you need to secure the keys to your dream home.

Things To Know About

As you stand on the precipice of purchasing your first home, arm yourself with the essentials that transform challenges into triumphs. The path to homeownership is lined with steps that we will demystify, infusing you with the confidence to move forward decisively.

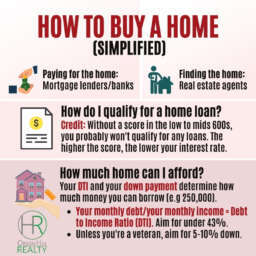

1. Start with a Budget

Before stepping into the arena, know your financial fighting weight. Determine a budget that aligns with your financial reality and aspirations. Obtain a mortgage pre-approval so sellers recognize your commitment and seriousness. It’s a strategic first punch in the home buying bout.

2. Location, Location, Location

The age-old real estate mantra holds true. Your future home’s location is pivotal. Delve into the neighborhoods that resonate with your lifestyle. Consider commute times, schools, amenities, and community culture. Remember, you’re not just buying a house; you’re investing in your quality of life.

3. Home Inspections

Forewarned is forearmed. A meticulous home inspection can reveal hidden defects and prevent future financial headaches. Enlist a reputable inspector to examine the property. It’s the shield you need in your home buying arsenal.

4. Understanding the Buying Process

From selecting a real estate agent to signing on the dotted line at closing, each step in the home buying process should be approached with informed intent. Grasp the sequence of events and the roles of all parties involved to ensure a smooth transaction.

5. Financing Options

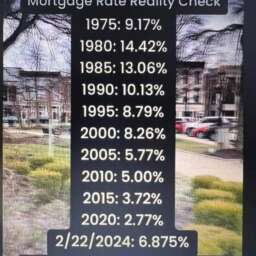

The mortgage landscape is as varied as it is complex. From fixed-rate to adjustable mortgages, comprehend the financing instruments at your disposal. Partner with financial professionals to identify a mortgage that fortifies your economic stability.

6. Consider Additional Costs

Beyond the sticker price lies a spectrum of additional costs. Property taxes, homeowner’s insurance, HOA fees, and maintenance expenses all weigh on the scale of affordability. Account for these to maintain financial balance.

7. Negotiating the Price

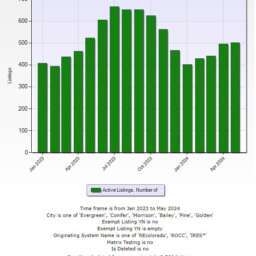

The art and science of negotiation can mean the difference between a good deal and a great one. Equip yourself with market data, sales trends, and an unshakable sense of the property’s value. Negotiate from a position of strength.

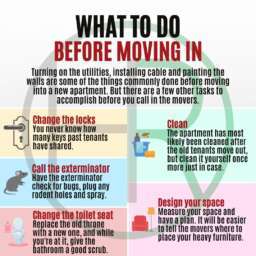

8. Homeownership Responsibilities

Owning a home comes with a set of responsibilities that you must embrace. From routine upkeep to crucial repairs, be prepared for the obligations that ensure your home remains a bastion of comfort and security.

9. Researching Builders and Sellers

Due diligence in verifying the reputation of your home’s builder or previous owners is a foundational element of a sound purchase. History speaks volumes; make sure you listen.

10. Future Resale Value

Consider your home not just as a hearth, but as a potential harvest. Evaluate the property’s potential resale value to ensure that your investment today reaps rewards tomorrow.

We’ve marched through the fundamentals, each step a cornerstone laying the foundation of an informed home-buying strategy. With this knowledge, embark on your quest for ownership. Know that our commitment to service excellence and community trust is your ultimate ally. We’re here to ensure that when you turn the key to your new home, you do so with the confidence of a savvy, well-informed buyer. Let’s get started! End of Document

Additional content related to the general topics discussed

The Importance of Research and Due Diligence

Purchasing a home is not just about finding the perfect house, it’s also about finding the right builder or seller. It’s crucial to conduct thorough research and due diligence on all parties involved in the sale. This can include looking into the builder’s track record, reading reviews from previous customers, and ensuring that there are no red flags in the seller’s history. By doing your homework, you can avoid potential issues and ensure a smooth transaction.

The Value of Partnership

Buying a home is a major financial decision that requires careful consideration. It’s important to partner with professionals who have your best interests at heart and can provide valuable guidance throughout the process. This includes working with a reputable real estate agent, mortgage lender, and home inspector. With their expertise and support, you can make informed decisions that align with your goals and financial situation.

The Long-Term Benefits of Owning a Home

While buying a home is certainly an investment in the present, it’s also an investment in your future. Homeownership comes with a variety of long-term benefits such as building equity, stability, and potential for resale value. By understanding these benefits and considering them in your decision-making process, you can feel confident that you are making a wise investment for both today and tomorrow. End of Text

Keep Learning and Growing

The home buying process is complex and constantly evolving. Even after you purchase your dream home, there will always be more to learn about homeownership, from maintenance to taxes to market trends. Embrace a mindset of continuous learning and growth as a homeowner, and you’ll set yourself up for long-term success in your new property. We are committed to being your go-to resource for all things related to homeownership, so don’t hesitate to reach out with any questions or concerns. We’re here to support you every step of the way. End of Section

So remember, as you embark on your journey towards homeownership, maintain an authoritative and confident tone while also being helpful and informative. Stay proactive and enthusiastic about the process, but also emphasize the importance of thorough research and due diligence. And most importantly, trust in our brand’s commitment to excellence and community involvement as your ultimate ally in this exciting and life-changing endeavor. Let’s get started! End of Document

Additional content related to financing options

Types of Mortgages

When it comes to financing your home, there are a variety of mortgage options available. Some common types include fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans like FHA and VA loans. Each type has its own pros and cons, so it’s important to carefully consider your financial situation and goals when choosing a mortgage.

Working with a Mortgage Professional

Navigating the world of mortgages can be overwhelming, which is why it’s important to work with a mortgage professional who can guide you through the process. They can help you understand your options, determine how much house you can afford, and assist with the application and approval process. With their expertise, you can feel confident in your financing decisions.

Budgeting for Homeownership Costs

In addition to the cost of the home itself, there are other expenses that come with homeownership, such as property taxes, insurance, and maintenance. It’s important to budget for these costs in order to maintain financial balance and avoid any surprises down the road. A mortgage professional can help you estimate these costs and factor them into your overall budget.

Financing Assistance Programs

Depending on your income and location, there may be financing assistance programs available to help make homeownership more affordable. These programs can offer down payment assistance, low interest rates, or other benefits to eligible buyers. Research and inquire about these options to see if you qualify and how they can benefit your home purchase. End of Text

The Importance of Credit Score

Your credit score plays a significant role in the mortgage application process and determines your eligibility for certain loans and interest rates. Before applying for a mortgage, it’s important to check your credit score and address any issues that may lower it. This can help you secure better financing options and save money in the long run.

Don’t Overextend Yourself

When determining how much house you can afford, it’s important to consider not just your current financial situation, but also potential changes in the future. It’s recommended to stick to a conservative budget and avoid overextending yourself, as unforeseen circumstances can arise that may impact your ability to make mortgage payments. Remember, it’s always better to err on the side of caution when it comes to your finances.

Grace Wright

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇