10 tips on what to know or do before buying a home

It’s important to be well-prepared before making the significant decision to buy a home. From financial considerations to location preferences, there are many factors to take into account to ensure a successful and satisfying home purchase. In this article, we’ll provide you with 10 important tips to guide you through the buying process and help you make informed choices that will set you up for success in your new home.

Hire Real Estate Agent

Check agent credentials

Keep in mind that not all real estate agents are the same. It’s crucial to check the credentials of the agent you are considering hiring. Look for agents who are licensed, experienced, and have a good track record of helping clients buy homes. You can verify an agent’s credentials through online databases or by contacting your state’s real estate regulatory agency.

Define your needs

To ensure you find the right home, you must first define your needs and preferences. This will help your agent narrow down the search and show you properties that align with your requirements. Consider factors such as your budget, location preferences, the size of the property, and any specific features you desire in a home.

Real Estate Agent

Once you have a clear idea of what you are looking for in a home, communicate these needs to your real estate agent. A good agent will take the time to understand your criteria and only show you properties that fit your requirements. This will save you time and ensure that you find a home that meets your needs and expectations.

Assess Finances

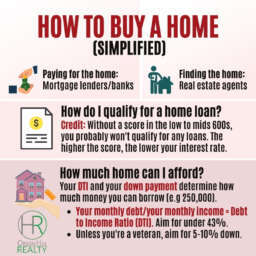

Review credit score

Finances are a critical aspect of buying a home, starting with understanding your credit score. Lenders use this score to determine your creditworthiness and the interest rates you qualify for. Reviewing your credit score will give you an idea of where you stand financially and help you identify any areas for improvement before applying for a mortgage.

Budget for costs

Some of the most important aspects of your financial assessment when purchasing a home involve budgeting for costs. Apart from the down payment and monthly mortgage payments, you must also consider additional expenses like closing costs, property taxes, insurance, maintenance, and utilities. Creating a comprehensive budget that includes all these costs will give you a realistic view of what you can afford and allow you to plan your finances accordingly.

Research Mortgages Options

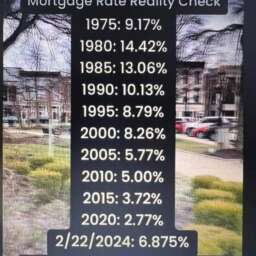

Compare Interest Rates

Some of the most crucial aspects to consider when researching mortgage options are interest rates. Different lenders offer varying rates, so it’s vital to compare and find the best option for your financial situation. Below is a table outlining interest rates from different lenders:

| Lender | Interest Rate |

| ABC Bank | 3.25% |

| XYZ Credit Union | 3.10% |

Understand Loan Types

Researching loan types is also crucial before making any decisions. Understanding the differences between fixed-rate and adjustable-rate mortgages can help you choose the one that best suits your needs. Here is a breakdown of the most common loan types:

- Fixed-Rate Mortgage

- Adjustable-Rate Mortgage

- Federal Housing Administration (FHA) Loan

- Veterans Affairs (VA) Loan

- Jumbo Loan

Now, let’s dive deeper into understanding loan types. Here is a table breaking down the details of each loan type:

| Loan Type | Description |

| Fixed-Rate Mortgage | Interest rate stays the same for the life of the loan. |

| Adjustable-Rate Mortgage | Interest rate can fluctuate based on market conditions. |

| Federal Housing Administration (FHA) Loan | Backed by the FHA, ideal for first-time homebuyers. |

| Veterans Affairs (VA) Loan | Available to eligible veterans and active-duty service members. |

| Jumbo Loan | For loan amounts that exceed conventional loan limits. |

Save for Down Payment

Plan savings strategy

One of the necessary steps before buying a home is saving for a down payment. Start by evaluating your current financial situation and setting a realistic savings goal. Create a savings plan by cutting back on unnecessary expenses, setting up automatic transfers to a dedicated savings account, and looking for additional sources of income to boost your savings.

Consider loan requirements

If you’re planning to apply for a home loan, it’s crucial to understand the down payment requirements set by lenders. Most conventional loans require a down payment of at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI). However, some loan programs, such as FHA loans, offer options for lower down payments, but it’s necessary to weigh the pros and cons of each loan type before making a decision.

Discover Government Programs

Investigate federal assistance

For a prospective homebuyer, it’s important to explore the various government programs available at the federal level. You can investigate programs such as FHA loans, VA loans, and USDA loans which offer competitive interest rates and low down payments, making homeownership more achievable.

Explore local initiatives

Any prospective homebuyer should also look into local government initiatives that aim to assist with purchasing a home. Many cities and counties offer down payment assistance programs, grants for first-time homebuyers, or tax incentives to make buying a home more feasible. It’s worth researching what options may be available in the area where you plan to buy your home.

It’s important to note that these programs usually have specific eligibility criteria, so be sure to check the requirements and guidelines before applying. Taking advantage of government programs can significantly reduce the financial burden of buying a home and help you achieve your homeownership goals sooner.

Select Desired Location

Research neighborhoods

Unlike any other aspect of buying a home, the location is something you can’t change. Take the time to research different neighborhoods to find one that fits your lifestyle and preferences. Consider factors like safety, schools, accessibility to work, and overall vibe of the community.

Proximity to amenities

Proximity to amenities is crucial when choosing a location for your new home. You’ll want to consider the distance to grocery stores, shopping centers, restaurants, parks, and other conveniences. Living near these amenities can save you time and make your daily life more convenient.

While some homebuyers prefer peace and quiet in a more secluded area, others may prioritize being close to entertainment and services. Make sure to weigh the pros and cons of different location choices based on your individual needs and preferences. Keep in mind that locations closer to amenities may come with a higher price tag, so budget accordingly.

Consider Long-Term Plans

Future Family Size

All decisions made when buying a home should be influenced by long-term plans. Consider the size of your future family when selecting a house. Will you be expanding your family in the coming years? It’s important to choose a home that can accommodate potential growth, whether it’s adding more bedrooms or ensuring there’s enough space for children to play.

Career Location Stability

Little is as crucial as considering your career location stability when buying a home. Are you in a job that requires frequent relocations, or do you anticipate staying in the same area for the foreseeable future? If your job involves moving often, you may want to opt for a more flexible living situation. However, if you have long-term job security in a specific location, purchasing a home can be a wise investment in your future.

When considering career location stability, it’s crucial to factor in commute times, access to public transportation, and proximity to your workplace. These elements can significantly impact your daily life and overall satisfaction with your new home.

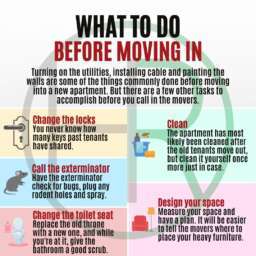

Inspect Property Condition

Hire professional inspector

Little can offer insight into the true condition of a property like a professional inspector. When considering a potential home purchase, it is crucial to hire a qualified inspector to thoroughly assess the property. They will look for structural issues, plumbing or electrical problems, potential pest infestations, and more. Their expertise can uncover hidden issues that may not be visible to the untrained eye, helping you make an informed decision about the property.

Evaluate repair costs

Even a well-maintained property may require some repairs or upgrades before you move in. It is vital to evaluate the potential repair costs associated with the property before making a purchase. Consider factors such as the age of the home, the condition of major systems like HVAC or roof, and any cosmetic updates that may be needed. By estimating these costs upfront, you can budget accordingly and avoid any financial surprises down the road.

You can also consult with contractors or service providers to get quotes on potential repairs. This can give you a clearer picture of the investment required to bring the property up to your desired standards. Being proactive in evaluating repair costs will help you make a well-informed decision when purchasing a home.

Prepare for Negotiations

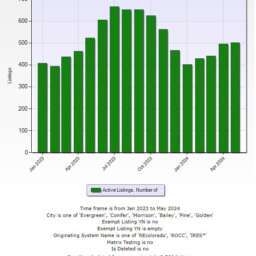

Know market values

Many homebuyers make the mistake of plunging into negotiations without a clear understanding of the current market values. There’s no room for assumptions in real estate negotiations, so take the time to research and compare similar properties in the area. Understanding market prices will give you a competitive edge and help you make informed decisions during negotiations.

Determine offer limits

There’s a delicate balance between getting a good deal and overpaying for a property. Before entering negotiations, prepare by setting clear offer limits based on your budget, the property’s value, and your priorities. Prepare to walk away if the price exceeds your predetermined limits, as staying within your financial boundaries is crucial for a successful home purchase.

Prepare for negotiations by having a clear understanding of the market values and setting realistic offer limits. Determine your top offer and the maximum amount you are willing to pay for the property. Having these boundaries in place will help you negotiate confidently and secure a deal that aligns with your financial goals.

Buying a Home

Having a clear understanding of your finances, doing thorough research on the market, getting pre-approved for a mortgage, and working with a knowledgeable real estate agent are some of the necessary tips to keep in mind before buying a home. Additionally, conducting a home inspection, considering the location, factoring in additional costs, and anticipating future needs are also crucial aspects to consider. By following these tips, you can make a well-informed decision and navigate the home buying process with confidence and ease. Recall, purchasing a home is a significant investment, so taking the time to prepare and educate yourself beforehand can help you find the perfect home that meets your needs and suits your budget.

Bill Brown

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇