Financing scenario/question template

A lot of the questions from investors amount to “how can I finance this?” with scant details that would allow for accurate answers. Please copy/paste this template when making a new thread about a financing scenario or question, and fill it in accordingly, to ensure you get the best answers to your question possible!

Your goals and story: What are you trying to accomplish, how are you trying to accomplish it, and what hurdles (if any) have you faced.

Type of property: Single family home, manufactured home, RV/trailer, multi-family (specify unit count), mixed use (specify resi v commercial unit counts and approximate square footage distribution between the two), hotel, casino, mobile home park, other (specify).

Location of property: State at a minimum, county better, city would be nice, zip code if you’re comfy sharing.

Purpose of financing: purchase, rate/term refinance, cash out refinance, upgrades/reno, construction, other (specify).

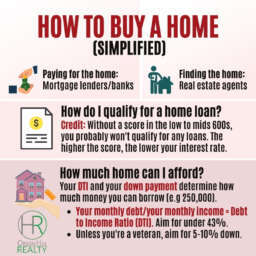

Type of financing sought: Not sure, Fannie/Freddie, hard money, private, seller-carried, subject-to, loan assumption, blanket loan, commercial, FHA, VA, USDA, 2nd position, SBA, fix-n-flip hard money, personal loan, HELOC.

Current or prior ownership of real estate: Currently own other real estate (how many properties?), recently owned other real estate, have not owned any real estate within the last 3 years.

Occupancy: investment with traditional long term leases, second or vacation home, owner occupied, family member (specify), short term furnished rental, rent-to-own, NNN, other (specify).

Value of property at present and/or your offer price: $

After repair value: $

Anticipated or actual appraisal issues: no, yes (what?)

Current rents per month: $

Fair market rents per month: $

Down payment or equity: specify down payment for purchase mortgage, or how much equity you will have in the property afterwards if a refinance.

Source of down payment funds, if applicable: own funds, unsecured borrowed funds (credit cards), secured borrowed funds (HELOC, etc), gifted funds, other (explain)

Income Source: Salaried/hourly W2, 1099 independent contractor (what industry and how long?), it’s complicated, student, self-employed (what industry and how long?), financially independent as a landlord, career tenant/victim that sues landlords for discriminating against my emotional support chickens, retired, other (explain)

Gross monthly income (optional): $

Monthly debt obligations appearing on credit report, plus (if applicable) personal rent and alimony/child support/etc: $

FICO: Excellent, good, ok, bad, you don’t want to know, not sure.

Credit issues: Late credit cards, thin/no credit, Ch7 bankruptcy, Ch13 bankruptcy, foreclosure, short sale, etc, and how long ago the event was.

Additional details:

Nate Marshall

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇