First-time home buyers 2024

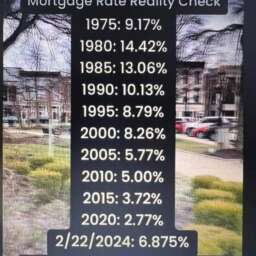

Home prices and interest rates are up. If rates drop prices will go up because of backed-up demand. There will be no “better time” to buy than any other for the next 5 to 10 years. Your monthly payment will fluctuate no matter what happens. Buyers need to understand buying a home is not a cheap process anymore. But it is still a great investment! As long as you don’t believe HGTV and think you will make 4x your money by remodeling the guest bathroom and have realistic expectations, you will grow your wealth and a consistent pace as markets continue to appreciate at a much more reasonable, buy.. In other words, if you want to own a home, buy one. You won’t be unhappy (most likely).

Buying a home for the first time in 2024 can be an exciting yet daunting experience. With the real estate landscape constantly evolving, it’s crucial to stay informed and prepared. Here are some comprehensive tips for first-time homebuyers:

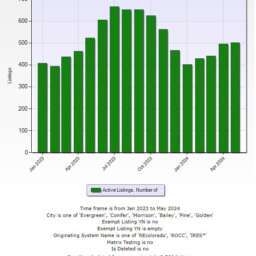

Understanding Market Trends

- Research Local Market Conditions: Stay updated on the real estate trends in your area of interest, especially in Evergreen, Colorado, or Marco Island, Florida, if considering these locations. Factors such as average home prices, inventory levels, and the average time homes stay on the market are critical.

- Economic Factors: Pay attention to national economic indicators like interest rates, inflation, and employment rates, as they can significantly affect mortgage rates and home prices.

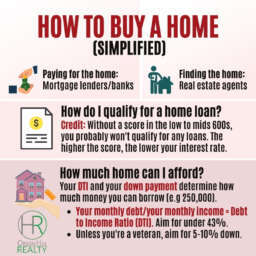

Financial Preparedness

- Budgeting: Determine how much you can afford. Consider not only the mortgage but also property taxes, insurance, maintenance, and possible homeowners association (HOA) fees.

- Credit Score: A good credit score can qualify you for better mortgage rates. Check your credit report, rectify any errors, and improve your score if necessary.

- Saving for Down Payment: Aim to save for a substantial down payment. While there are loan options with lower down payments, a larger down payment can lower your monthly payments and potentially eliminate the need for private mortgage insurance (PMI).

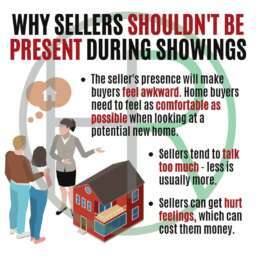

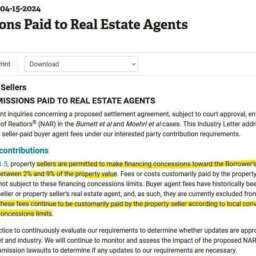

- Hiring a Real Estate Agent: A knowledgeable real estate agent, especially one familiar with Orson Hill Realty in Colorado or Platinum Real Estate in Florida, can guide you through the buying process, from finding homes within your budget to navigating negotiations and closing.

- Mortgage Pre-Approval: Getting pre-approved for a mortgage gives you a clear idea of what you can afford and shows sellers that you are a serious buyer.

The Home Buying Process

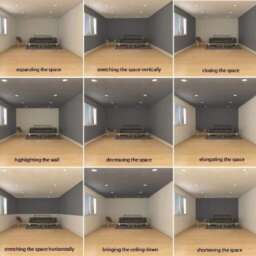

- Home Search: Make a list of your needs and wants in a home. Consider location, size, type of home, and amenities. Use online resources and your agent’s expertise to find properties that match your criteria.

- Home Inspections: Always conduct a thorough home inspection to check for any hidden problems. This can save you from costly repairs in the future.

Making an Offer and Closing

- Making an Offer: Your agent can help you make a competitive offer based on comparable homes and market conditions. Be prepared to negotiate.

- Closing Process: Understand the closing process, which includes a lot of paperwork, legal formalities, and finalizing your mortgage.

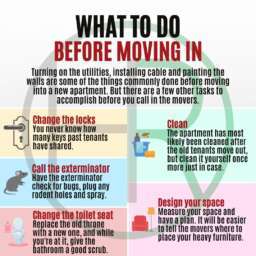

After Purchase Considerations

- Home Maintenance: Owning a home requires regular maintenance to keep its value. Plan for routine upkeep and unexpected repairs.

- Insurance and Warranties: Ensure you have adequate homeowner’s insurance. Consider a home warranty for additional protection against costly repairs.

FAQs for First-Time Homebuyers in 2024

Q: How much should I save for a down payment in 2024? A: Ideally, aim to save 20% of the home’s purchase price to avoid PMI. However, there are loan programs available that require as little as 3-5% down.

Q: Is it better to buy in Evergreen, Colorado, or Marco Island, Florida, as a first-time homebuyer? A: Both locations have unique offerings. Evergreen offers a serene mountain lifestyle, while Marco Island provides a coastal living experience. Your choice should depend on your lifestyle preferences, budget, and employment opportunities.

Q: How do I know if I’m getting a fair price on a home? A: Compare the home’s price with similar properties in the area. Your real estate agent can provide a comparative market analysis (CMA) to ensure you’re paying a fair price.

Q: Should I expect to negotiate the asking price? A: Yes, negotiation is a normal part of the home-buying process. Your offer may depend on market conditions, the home’s condition, and how long it’s been on the market.

Q: Are there any special programs for first-time homebuyers in 2024? A: Yes, there are several first-time homebuyer programs and grants that offer down payment assistance and favorable loan terms. Research federal, state, and local programs for opportunities.

Remember, buying your first home is a significant milestone. Take your time, do your research, and don’t hesitate to seek professional advice from trusted real estate experts. For more information, you can visit Orson Hill Realty, Platinum Real Estate, or other reputable sources.

Danny Skelly

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇