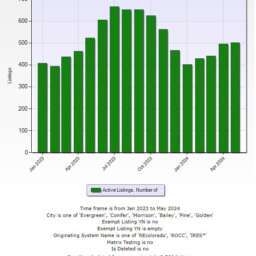

The Lakeland-Winter Haven metro area in Florida has seen significant fluctuations in its real estate market throughout 2023. A key aspect of this trend is the foreclosure rate, which has risen to be one of the highest in the

The real estate market of the Lakeland-Winter Haven metro area in Florida has undergone notable changes in 2023, particularly in terms of its foreclosure rate and housing market trends. This article delves into these aspects, providing a comprehensive overview of the current real estate scenario in this region.

Foreclosure Rate in Lakeland-Winter Haven

The Lakeland-Winter Haven area has experienced a significant foreclosure rate in the first half of 2023. Approximately one in every 347 homes underwent foreclosure, ranking this area as the fifth highest among 223 metropolitan statistical areas in the U.S. with populations exceeding 200,000. This rate is a 4.2% increase from the same period in 2022, highlighting a growing concern in housing stability.

Winter Haven Housing Market Trends

In Winter Haven, the housing market is somewhat competitive. Homes usually receive around three offers and sell in an average of 31 days. The median sale price of homes was $300K last month, showing a slight decrease of 0.53% compared to the previous year. The sale price per square foot has risen to $182, marking a 2.5% increase from last year. The sale-to-list price ratio in Winter Haven stood at 98.3%, with 13.5% of homes selling above the list price. However, there was a considerable rate of price drops, with 34.9% of homes experiencing reductions in their asking prices.

Lakeland Housing Market Insights

Lakeland’s housing market mirrors the competitive nature of Winter Haven. On average, homes in Lakeland receive one offer and take about 24 days to sell. The median sale price was $310K last month, a marginal decrease of 0.46% from the previous year. The median sale price per square foot increased to $190, up 2.4% since last year. The sale-to-list price ratio was 98.0%, and a significant 23.4% of homes were sold above the list price. However, price drops were observed in 39.2% of homes, indicating a fluctuating market.

Migration and Relocation Trends

The migration patterns in these areas also shed light on the housing market dynamics. In Lakeland, about 33% of homebuyers looked to move out of the city, while 67% preferred to stay within the metropolitan area. New York homebuyers showed the most interest in moving to Lakeland, followed by those from Miami and Washington. In contrast, 67% of Winter Haven homebuyers searched to stay within their own metropolitan area, with Ocala being the most popular destination among those looking to move.

Foreclosures in Lakeland-Winter Haven

The real estate market in the Lakeland-Winter Haven metro area is characterized by its competitiveness, fluctuating home prices, and a concerning rate of foreclosures. These trends reflect the dynamic nature of the housing market in this part of Florida and provide insights for potential buyers, sellers, and investors looking to navigate this market.

What is the current foreclosure rate in the Lakeland-Winter Haven metro area, and how does it compare nationally?

The Lakeland-Winter Haven metro area has experienced a notable increase in foreclosures in 2023. Approximately one in every 347 homes faced foreclosure in the first half of the year, making it the fifth highest rate among metropolitan areas with populations over 200,000 in the United States. This rate represents a 4.2% increase from the previous year. The rise in foreclosures in this region is significant and indicates a growing concern about housing stability, contrasting with national trends where foreclosure rates have generally been on a decline since the recovery from the last housing crisis.

How competitive is the housing market in Winter Haven, and what are the current trends in home prices?

Winter Haven’s housing market is currently somewhat competitive, with homes typically receiving three offers and selling within an average of 31 days. The median sale price has slightly decreased by 0.53% from the previous year to $300K, while the median sale price per square foot has increased to $182, indicating a 2.5% rise. These trends suggest a stable yet competitive market, with homes selling relatively quickly but at slightly lower prices than the previous year. The market also shows a moderate rate of price drops, with about 34.9% of homes experiencing price reductions.

What are the key characteristics of Lakeland’s real estate market?

Lakeland’s real estate market mirrors the competitiveness of Winter Haven but with some distinct characteristics. Homes in Lakeland typically receive one offer and sell in about 24 days. The median sale price is $310K, showing a decrease of 0.46% from last year. The median price per square foot, however, has risen to $190, indicating a 2.4% increase. The market in Lakeland is dynamic, with about 23.4% of homes selling above the list price and 39.2% experiencing price drops, reflecting a market that is competitive yet variable in terms of pricing.

How are migration and relocation trends affecting the Lakeland-Winter Haven housing market?

Migration and relocation patterns provide a unique insight into the Lakeland-Winter Haven housing market. In Lakeland, about a third of homebuyers are looking to move out of the city, while two-thirds prefer to stay within the metropolitan area. Interestingly, homebuyers from New York are showing significant interest in moving to Lakeland. In contrast, Winter Haven sees a majority of its homebuyers preferring to stay within the metropolitan area, with Ocala being a popular destination for those looking to move. These trends indicate a diverse range of preferences among homebuyers, influencing the demand and supply dynamics in the housing market.

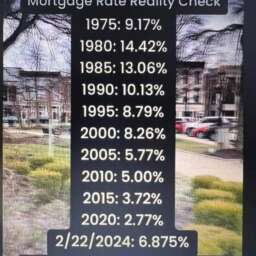

What implications do the current market trends have for buyers and sellers in the Lakeland-Winter Haven area?

The current trends in the Lakeland-Winter Haven area have various implications for buyers and sellers. The somewhat competitive nature of the market, combined with the fluctuating home prices and high foreclosure rates, suggests that buyers may find opportunities in terms of pricing but should be cautious about the stability of their investments. Sellers, on the other hand, might face challenges in achieving their desired sale prices, particularly with the increasing trend of price drops. However, the relatively quick sale times indicate a steady demand. Both buyers and sellers should stay informed about the latest market trends and consider working with experienced real estate professionals to navigate this dynamic market effectively.

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇