I will be creating a comprehensive master plan for a 100-module virtual education program for real estate investors involves organizing the content logically and ensuring a smooth progression of topics. Each module, taking into account offering flexibility for participants, will be 5-7 minutes in length, should focus on specific aspects of real estate investment. Below is a suggested outline for the program:

Module 1-5: Introduction to Real Estate Investing

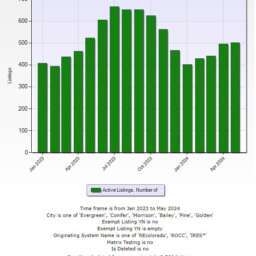

- Module 1: Overview of Real Estate Markets

- Introduction to different real estate markets

- Trends and opportunities

- Module 2: Understanding Asset Classes

- Residential, commercial, industrial, and retail

- Pros and cons of each asset class

- Module 3: Importance of Real Estate Investment

- Historical performance

- Diversification benefits

- Module 4: Setting Investment Goals

- Short-term vs. long-term objectives

- Risk tolerance assessment

- Module 5: Legal and Regulatory Landscape

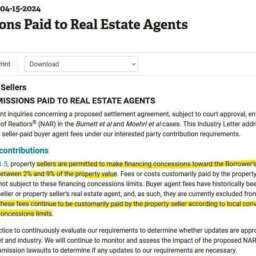

- Overview of real estate laws

- Regulatory considerations

Module 6-25: Asset Classes Deep Dive

- Module 6-9: Residential Real Estate

- Single-family homes, condos, apartments

- Rental strategies and property management

- Module 10-13: Commercial Real Estate

- Office, retail, industrial

- Lease structures and commercial property management

- Module 14-17: Specialized Asset Classes

- Vacation rentals, senior housing, student housing

- Niche market strategies

- Module 18-21: Real Estate Development

- Overview of the development process

- Risks and rewards

- Module 22-25: International Real Estate Investing

- Opportunities and challenges

- Currency and legal considerations

Module 26-45: Acquisition Strategies

- Module 26-29: Traditional Buying

- MLS, auctions, off-market deals

- Negotiation skills

- Module 30-33: Creative Financing

- Seller financing, lease options

- Creative deal structures

- Module 34-37: Wholesaling and Flipping

- Strategies for quick profits

- Market analysis for flips

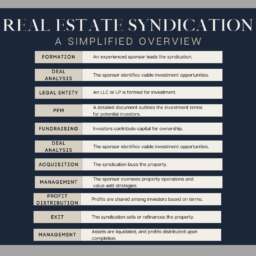

- Module 38-41: Syndication and Joint Ventures

- Pooling resources for larger deals

- Legal and financial considerations

- Module 42-45: Crowdfunding

- Online platforms and regulations

- Due diligence in crowdfunding

Module 46-65: Funding Strategies

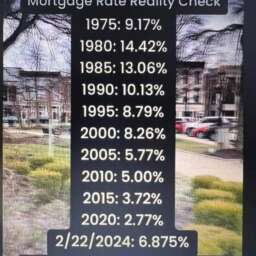

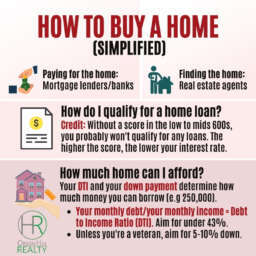

- Module 46-49: Traditional Financing

- Mortgages, loans, and credit

- Loan qualification and application process

- Module 50-53: Private Money and Hard Money

- Finding private lenders

- Hard money lending dynamics

- Module 54-57: Government Programs

- FHA, VA, and other government-backed loans

- Eligibility criteria

- Module 58-61: Creative Funding Solutions

- Self-directed IRAs, 401(k) loans

- Using other people’s money

- Module 62-65: Risk Management

- Insurance for real estate investments

- Mitigating financial risks

Module 66-85: Front Office Processes

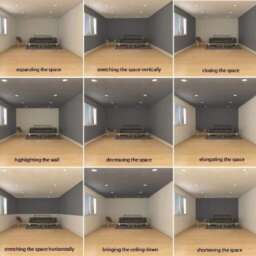

- Module 66-69: Property Analysis

- Evaluating property values

- Conducting comparative market analysis

- Module 70-73: Due Diligence

- Legal, financial, and physical due diligence

- Identifying red flags

- Module 74-77: Marketing and Branding

- Building an investor brand

- Marketing properties effectively

- Module 78-81: Negotiation Skills

- Techniques for successful negotiations

- Handling objections

- Module 82-85: Networking and Relationship Building

- Building a real estate network

- Partnerships and collaborations

Module 86-100: Back Office Processes

- Module 86-89: Financial Management

- Accounting principles for real estate

- Budgeting and financial planning

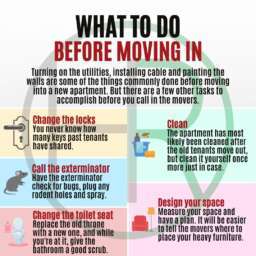

- Module 90-93: Property Management

- In-house vs. third-party management

- Tenant relations

- Module 94-97: Legal Compliance

- Eviction processes

- Fair housing laws

- Module 98-100: Exit Strategies and Legacy Planning

- Selling properties for profit

- Legacy planning for real estate portfolios

This master plan provides a structured and comprehensive approach to real estate investment education, covering a wide range of topics in short, digestible modules. Each module focuses on specific skills and knowledge crucial for success in the real estate investment landscape. It will offer flexibility for scheduling plus participants can refresh and retake modules as needed. There will be more modules added. These will be hosted by partners who will share in the revenue at 3 different levels with the amounts TBD.

Nate Marshall

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇