N.A.R.’s Landmark Commission Settlement

In an unprecedented move, the National Association of Realtors (N.A.R.) has agreed to a monumental $418 million settlement in response to a series of lawsuits. This decision not only aims to compensate for past grievances but also marks a pivotal shift in the housing market by modifying commission structures. Below, we delve into the details of this settlement and its potential implications for the real estate industry.

The Settlement at a Glance

- Settlement Amount: N.A.R. agrees to a $418 million compensation package.

- Impact on Commission Rules: Key rules regarding commissions are to be abolished, promising to lower the cost of selling homes.

- Consumer Choice and Member Protection: According to Nykia Wright, interim chief executive of N.A.R., the settlement is designed to safeguard consumer choices and ensure member protection.

Anticipated Market Transformation

Industry experts are predicting this settlement could lead to the most significant upheaval in the U.S. real estate market in a century. The changes could mimic the disruption seen in the travel industry with the advent of platforms such as Expedia and Kayak, introducing new business models and competitive pricing strategies.

Key Points:

- Reduction in Selling Costs: Homeowners across the United States could see a notable decrease in the expenses associated with selling their properties.

- Innovation in Real Estate: The settlement is expected to foster innovation, leading to new and creative service offerings for home buyers and sellers.

The Current Landscape of Real Estate Commissions

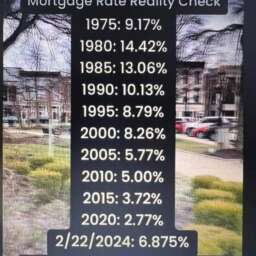

The traditional commission structure in the U.S. real estate market has long been a subject of debate. With the U.S. spending approximately $100 billion annually on real estate commissions, the settlement could introduce a much-needed reduction in these costs.

Commission Structures:

- U.S. vs. International Rates: U.S. real estate agents typically charge a commission of 5 to 6 percent, significantly higher than the 1 to 3 percent rates seen in many other countries.

- Impact on Home Prices: High commission rates are factored into the final sales price of homes, affecting both sellers and buyers.

The Future of Real Estate Transactions

This settlement could revolutionize how real estate transactions are conducted, making the process more transparent and competitive.

Expected Changes:

- Lower Commissions: Economists estimate a potential 30 percent reduction in commission rates, which would directly benefit consumers.

- Enhanced Market Competition: The settlement is likely to boost competition among realtors, leading to diverse pricing models and services.

N.A.R.’s Commitment to Change

Despite the turmoil and challenges faced, N.A.R. has shown a willingness to adapt and embrace change, as evidenced by their agreement to this settlement. This marks a significant step forward in addressing antitrust concerns and fostering a more competitive real estate market.

Settlement Highlights:

- Rule Revisions: The settlement mandates the elimination of rules that permitted the setting of standard commissions, encouraging a shift towards more competitive pricing.

- MLS Adjustments: Changes to the Multiple Listing Services (MLS) will enhance transparency and fairness in the listing and selling process.

Transformative Changes in Real Estate: N.A.R.’s Settlement Impact

The National Association of Realtors (N.A.R.), responding to class-action lawsuits from homeowners dissatisfied with high commission fees, has embarked on a path to reshape the real estate landscape. This move involves a substantial financial settlement and a series of policy overhauls aimed at reducing costs for home sellers and enhancing market competitiveness.

The Settlement Breakdown

- Financial Compensation: N.A.R. has agreed to a $418 million payout to address damages claimed in the lawsuits.

- Policy Overhaul: Central rules that have long governed the U.S. housing market are set for major revisions, which could significantly alter the industry’s operating norms.

Potential Industry Shifts

Pending judicial approval, these adjustments are poised to bring about significant changes in how real estate transactions are conducted:

Decrease in Home Selling Costs

Historically, selling a home in the U.S. involves a commission rate of 5 or 6 percent, directly impacting the selling price and the seller’s net proceeds. For instance, selling a $1 million property could traditionally cost up to $60,000 in commissions alone. This settlement could see these costs substantially reduced, benefiting sellers nationwide.

Industry Turbulence

The N.A.R. has recently faced increased scrutiny and internal challenges:

- Competition and Scandal: Following a turbulent year marked by scandals and the emergence of competing groups, the N.A.R. finds itself at a critical juncture.

- Leadership Changes: A series of sudden resignations among its top officials has added to the organization’s instability.

- Legal Challenges: A federal jury’s decision, viewing N.A.R.’s commission practices as anticompetitive, has prompted a reevaluation of its policies.

Decoupling of Commissions

A significant outcome of the settlement is the end of mandatory commission offers to buyers’ agents by sellers’ agents, leading to:

- Billions in Savings: This could translate into an estimated $20 billion to $50 billion reduction in annual real estate commissions.

- Enhanced Market Transparency: Sellers and buyers will likely engage in more negotiations and comparison shopping, fostering a more transparent pricing environment.

Evolution of Commission Norms

The settlement challenges the industry-standard commission rate, encouraging more competitive pricing and reflecting the value and effort provided by agents.

Reduction in Steering Practices

The dominance of N.A.R.-affiliated databases has faced criticism for fostering “steering” by agents. The settlement mandates the removal of compensation details from listings, aiming to curb this practice.

Potential Reduction in Real Estate Professionals

The booming housing market saw a surge in new real estate agents, but the evolving landscape and reduced commissions could lead to a significant decrease in the number of active agents, especially among those who have recently entered the industry.

Industry Outlook

Experts anticipate a substantial shift in the real estate profession, with potentially a million agents exiting due to the changing commission structures. This transition may favor established agents with strong client relationships and market knowledge over newcomers lacking a solid client base.

NAR Commission Lawsuit

N.A.R.’s settlement is set to redefine the real estate market, with lower commissions, enhanced competition, and a shift towards greater transparency and fairness in home selling. As the industry adapts to these changes, both sellers and buyers stand to benefit from more equitable transactions and a broader range of choices in real estate services.

NAR

The N.A.R. settlement represents a historic moment for the real estate industry, with the potential to transform housing market dynamics significantly. By promoting competitive practices and reducing barriers, this agreement could pave the way for a more equitable and efficient real estate market, benefiting consumers and industry professionals alike.

David Clark

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇

- Higher cost for buyers

- Pricing many buyers out of the market

- N.A.R.'s settlement responds to lawsuits over high commission fees.

- $418 million allocated for lawsuit damages.

- Policy revisions aimed at reducing seller costs.

- Anticipated decrease in home selling commissions.

- The settlement may introduce more competitive market conditions.

- Historical commission rates of 5-6% challenged.

- Legal and internal turmoil within N.A.R. highlighted.

- Decoupling of commission offers to buyers' agents.

- Potential annual savings in billions for homeowners.

- Enhanced negotiation and transparency in pricing expected.

- Settlement challenges industry-standard commission rates.

- Reduction in steering practices due to changes in listing requirements.

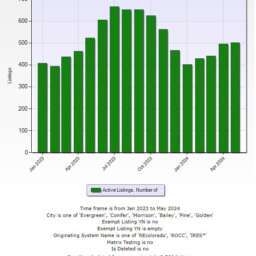

- Surge in real estate agents during the housing market boom.

- Potential for a significant decrease in the number of active agents.

- Established agents may fare better than newcomers post-settlement.

- The settlement could significantly impact agent competition and pricing strategies.

- A shift towards greater market transparency and fairness is expected.

- The real estate industry is poised for a historic transformation.

- Consumers stand to benefit from reduced transaction costs.

- The evolving landscape may favor those with strong market knowledge and client relationships.