Exploring the Differences Between Class A, Class B, and Class C Multifamily Apartment Complexes: A Comprehensive Guide for Real Estate Investors

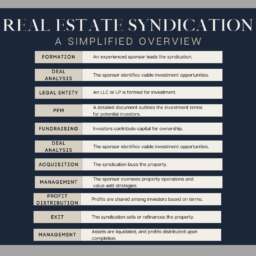

Note: I will explore syndications for multi-family real estate in another blog post.

Investing in multifamily apartment complexes can be a lucrative venture for real estate investors. However, understanding the nuances between different classes of properties is crucial for making informed decisions. In this article, we will delve into the distinctions between Class A, Class B, and Class C multifamily apartment complexes, exploring the amenities associated with each class. Additionally, we’ll discuss effective strategies that real estate investors can employ to increase rents, enhance property value, and retain tenants across these diverse property types.

Class A, Class B, and Class C Multifamily Apartment Complexes:

- Class A: Luxury Living and Premium Amenities

- Class A properties are characterized by high-end finishes, modern architecture, and premium amenities.

- Amenities often include upscale fitness centers, rooftop terraces, concierge services, and smart home technology.

- Located in prime, desirable neighborhoods with proximity to urban centers, entertainment, and cultural hubs.

- Class B: Balanced Features and Moderate Pricing

- Class B properties offer a balance between quality and affordability.

- Typically well-maintained and feature amenities like swimming pools, parking facilities, and communal spaces.

- Located in both urban and suburban areas, providing a middle-ground option for tenants seeking value without compromising on comfort.

- Class C: Affordable Housing with Basic Amenities

- Class C properties cater to more budget-conscious tenants.

- Basic amenities such as laundry facilities, limited recreational spaces, and standard maintenance services.

- Often situated in areas with lower property values, these complexes may require more attention to management and maintenance.

Strategies for Real Estate Investors:

- Increasing Rents:

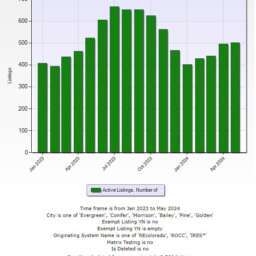

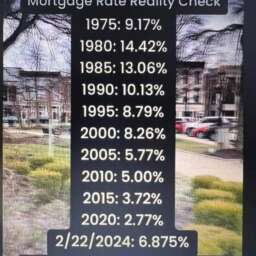

- Conduct a thorough market analysis to understand rental trends in the area.

- Implement property upgrades and renovations to justify rent increases.

- Offer additional services or amenities to enhance tenant experience.

- Enhancing Property Value:

- Regularly maintain and upgrade common areas and unit interiors.

- Invest in energy-efficient and sustainable features to attract environmentally-conscious tenants.

- Stay informed about local development plans and infrastructure improvements that can positively impact property values.

- Tenant Retention:

- Prioritize responsive property management and maintenance services.

- Establish community engagement initiatives, fostering a sense of belonging among tenants.

- Consider loyalty programs or incentives for long-term residents.

There are many resources available, Let me know if you need a direction.

Understanding the distinctions between Class A, Class B, and Class C multifamily apartment complexes is crucial for real estate investors aiming to navigate the diverse real estate landscape. By implementing strategic approaches to increase rents, enhance property value, and prioritize tenant retention, investors can optimize their returns and create sustainable, successful investments in the multifamily housing sector.

Nate Marshall

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇