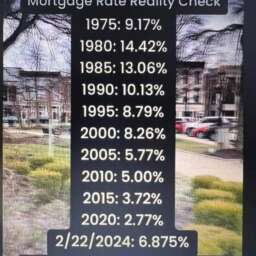

As more new investors join the market in hopes of capitalizing on the benefits of real estate, there are several things to be aware of. I have unfortunately been witness to some areas of misunderstanding.

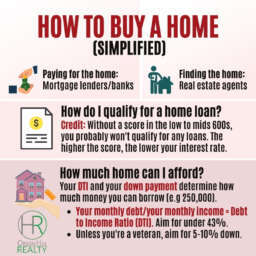

- You need to have access to capital- There are ways to team with investors to have the capital for down payments for a loan, but they will expect a return on their investment. This may result in a longer evaluation period and more requests for information. If you are planning to utilize other people’s funds to get into a deal, do not risk your investment by underestimating the time it will take to get approval for the extra funds.

- A perceived large spread does not guarantee the deal is worth it. There are costs involved with getting the funds. There are costs involved with selling or refinancing. A purchase price of 100K with 50k rehab and selling price of 225k does not mean you will make 75k profit. Also, be prepared that the 50k rehab could easily turn into 60k or more if you don’t have help with the initial inspection, or if it is done too quickly.

- An experienced broker will probably come off as cold. It’s not that they don’t want to help, but speaking from personal experience, being emotionally vested in a new clients success is a great source of heartburn. The experienced broker has likely been through it and created a way to keep them separate.

These are a few lessons I have experienced recently while trying to help clients.

Evan Zelkovich

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇