How To Successfully Invest In Real Estate For Fix And Flips

Flips are a popular way to make money in the real estate industry, and for those looking to successfully invest in fix and flips, there are key strategies to follow. From finding the right property at the right price to executing timely renovations and marketing the finished product effectively, each step plays a crucial role in the success of a fix and flip venture. In this informative blog post, we will research into the imperative tips and tricks to help investors navigate the world of fix and flips and maximize their profits in the real estate market.

Key Takeaways:

- Location is Key: Choosing the right location for your fix and flip property is crucial. Look for neighborhoods with high demand, good schools, and amenities.

- Due Diligence is Essential: Conduct a thorough inspection of the property and research the market before investing. Make sure to budget for unexpected costs that may arise during the renovation process.

- Work with a Reliable Team: Building a team of professionals, such as contractors, real estate agents, and lenders, can help ensure the success of your fix and flip project. Communication and trust are key in working with your team.

Understanding the Real Estate Market

Researching Your Target Market

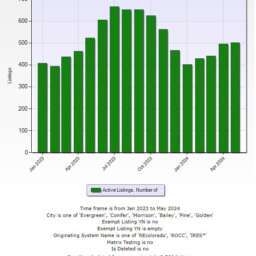

Market research is crucial when it comes to successfully investing in real estate for fix and flips. Understanding the demographics, economic indicators, and current trends in your target market will help you make informed decisions and maximize your profits. Take the time to analyze data, visit the neighborhood, and speak to local real estate agents to get a comprehensive understanding of the market dynamics.

Identifying Market Trends for Profitable Flips

Any successful real estate investor knows that identifying market trends is key to profitable fix and flips. Look for neighborhoods with increasing property values, high demand for housing, and a growing economy. These factors can indicate a hot market for fix and flips where you can buy low, add value through renovations, and sell high for a significant profit. Keep a close eye on market trends to stay ahead of the competition and make smart investment decisions.

Plus, consider factors like new infrastructure developments, job growth, and local amenities that can attract buyers to the area. By understanding the market trends and factors driving demand, you can strategically position your fix and flip properties for maximum profitability.

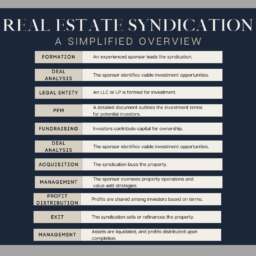

Financing Your Investment

Options for Funding Your Real Estate Deals

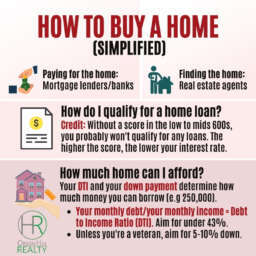

Your success in fix and flip real estate investing heavily relies on securing the right funding for your projects. There are various options available, including traditional bank loans, private money lenders, hard money loans, and crowdfunding platforms. Each option comes with its own terms, interest rates, and requirements, so it’s crucial to choose the one that aligns best with your investment goals and financial situation.

Smart Leverage: Using Loans and Mortgages Wisely

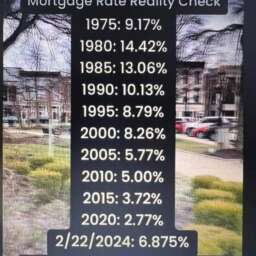

One key strategy for successful fix and flip investing is leveraging loans and mortgages wisely. By utilizing financing options effectively, you can maximize your purchasing power and increase your returns on investment. However, it’s important to approach leverage cautiously and only take on debt that you can comfortably manage. Consider factors such as interest rates, repayment terms, and potential market fluctuations before securing a loan for your real estate ventures.

Loans and mortgages can be powerful tools in your fix and flip real estate investment journey, allowing you to increase your buying power and tackle more projects than you could without financing. However, it’s crucial to carefully evaluate the terms and risks associated with each loan option before committing. Remember to factor in potential market changes and ensure that you have a solid plan in place for repayment to make the most of leveraging for your real estate investments.

Finding the Right Properties

Locating Underpriced Homes with Potential

Potential properties for fix and flips often include underpriced homes with the potential for value appreciation through renovation. Look for distressed properties, foreclosures, or homes in need of cosmetic updates that can be purchased below market value.

Assessing Renovation Needs and Costs

Costs associated with renovations are a crucial aspect of successful fix and flip investments. Assessing the renovation needs of a property involves evaluating the scope of work required, estimating costs for materials and labor, and forecasting the potential return on investment. Conduct a thorough inspection and work with experienced contractors to get accurate cost estimates.

Homes that require major structural repairs or have hidden issues like mold or water damage can significantly impact your bottom line. It’s important to accurately assess the extent of needed renovations and budget accordingly to avoid unexpected expenses.

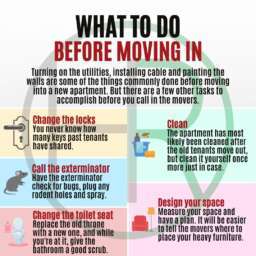

The Renovation Process

Planning Effective Renovations for Maximum Return

Effective planning is crucial when it comes to renovating a property for flipping. Before starting any renovations, conduct a thorough evaluation of the property to identify the key areas that need improvement. Focus on high-impact upgrades that can increase the property’s value significantly, such as updating kitchens and bathrooms, improving curb appeal, and fixing any structural issues. Set a budget and timeline for the renovations to ensure that you stay on track and maximize your return on investment.

Managing Contractors and Timelines

One of the key components of a successful renovation project is efficiently managing contractors and timelines. Choose experienced and reliable contractors who have a track record of delivering high-quality work on time and within budget. Clearly communicate your expectations and establish a detailed timeline for the project to keep everyone accountable. Regularly monitor progress and address any issues promptly to prevent delays and cost overruns.

Plus, consider creating incentives or penalties in the contract to motivate contractors to meet deadlines and maintain quality standards. By staying organized and proactive in managing contractors and timelines, you can ensure a smooth renovation process and maximize your profits.

The Selling Phase

Marketing Your Fixed-Up Property

Once again, the selling phase is a critical part of your fix-and-flip journey. Marketing your fixed-up property effectively is crucial to maximizing your return on investment. Utilize professional photography, staging, and online listings to showcase the property’s best features. Consider hiring a real estate agent with experience in the local market to help attract potential buyers.

Negotiating Sales and Understanding Market Timing

The negotiation phase plays a crucial role in the success of your fix-and-flip project. Property negotiations involve understanding market trends, setting the right price, and strategically timing your sale. Familiarize yourself with the local real estate market to make informed decisions. Stay flexible and open to negotiations to secure a favorable deal.

Your negotiation skills and market timing can significantly impact your profit margin. Keep a close eye on market conditions, such as supply and demand, interest rates, and competition. Be prepared to adjust your pricing strategy based on the current market trends to attract potential buyers and ensure a successful sale.

Risk Management

Avoiding Common Pitfalls in Fix and Flips

Common mistakes in fix and flip projects include underestimating renovation costs, overestimating the ARV (After Repair Value), and not properly vetting contractors. To avoid these pitfalls, conduct thorough research, create a detailed budget, and hire experienced professionals for the job.

Legal Considerations and Insurance

Risk management in real estate investing involves understanding the legal aspects of the business and having the right insurance coverage. It is imperative to consult with a real estate attorney to ensure compliance with local regulations, drafting airtight contracts, and protecting your assets. Additionally, having insurance policies such as liability, property, and builder’s risk insurance can provide financial protection in case of accidents or unforeseen events during the renovation process.

Considerations for legal matters and insurance are crucial for safeguarding your fix and flip investment. By addressing these aspects proactively, you can mitigate risks, protect yourself from potential liabilities, and ensure a successful outcome for your real estate project. Note, in real estate, proper risk management is key to long-term success.

Building a Fix and Flip Business

Scaling Your Real Estate Investments

To truly build a successful fix and flip business, scaling your real estate investments is vital. As you gain experience and resources, consider expanding your portfolio by acquiring more properties or taking on larger projects. This can help increase your profits and establish a solid reputation in the industry.

Creating Systems for Long-Term Success

Estate Creating systems for long-term success in your fix and flip business is crucial for sustainability and growth. By developing efficient processes for property acquisition, renovation, and sale, you can streamline your operations and maximize your profits. Implementing systems for project management, budgeting, and marketing can help ensure long-term success in the competitive real estate market.

It is important to continuously refine and optimize your systems to adapt to market changes and improve your business performance over time. By staying organized and proactive, you can position your fix and flip business for long-term success and profitability.

Ultimately, successfully investing in real estate for fix and flips requires a combination of thorough research, strategic planning, and effective execution. By carefully analyzing market trends, finding the right property at the right price, managing renovations efficiently, and marketing the finished product effectively, investors can maximize their returns on investment. It’s crucial to stay informed about the local real estate market, work with a reliable team of contractors and real estate professionals, and continuously adapt to changing market conditions to ensure success in fix and flip projects. With dedication, patience, and a well-thought-out strategy, investors can navigate the world of real estate investments and achieve profitable outcomes with fix and flips.

Robert Davis

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇