The Home-Buying Process

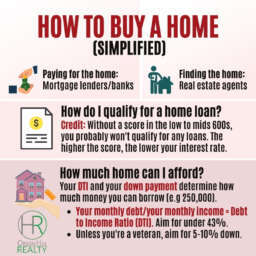

The home-buying process, while potentially daunting, especially for first-time buyers, can be navigated smoothly with understanding and preparation. The process begins with a thorough assessment of your financial situation, including understanding your credit score, savings for a down payment, and monthly mortgage affordability. This is followed by getting pre-approved for a mortgage, which not only gives you an idea of your borrowing capacity but also signals to sellers your seriousness as a buyer.

The next step involves finding a reputable real estate agent who can guide you through the process, from finding homes within your budget to negotiating with sellers. Once you have a budget and a real estate agent, you can start viewing homes. Make a list of your must-haves and nice-to-haves in a home, such as the number of bedrooms, bathrooms, and location. When you find a home that meets your criteria, you make an offer. Your agent can help you determine a fair price based on market trends and comparable properties in the area.

Before finalizing the purchase, it’s important to get a professional home inspection to uncover any potential issues with the property. Your agent can recommend reputable inspectors and help you navigate through the results. Once your offer has been accepted and all inspections have been completed, it’s time to close on your new home. Your agent will work closely with you and the seller’s agent to ensure all necessary paperwork is in order and guide you through the closing process. Remember, buying a home is a big decision, and it’s important to take your time and make sure you’re making the best choice for your needs and budget. Your real estate agent is there to guide you through the process and help you find your dream home.

The home-buying process can seem overwhelming, especially for first-time buyers. However, understanding each step can make the journey less daunting and more exciting. Here’s a guide to help you navigate the process:

Assess Your Financial Situation

Before you start looking for a home, it’s important to understand your financial situation. This includes knowing your credit score, how much you have saved for a down payment, and what you can afford to pay each month for a mortgage.

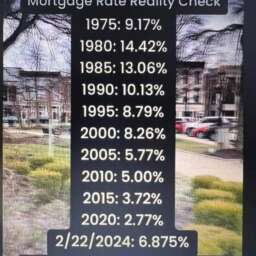

Get Pre-Approved for a Mortgage

Getting pre-approved for a mortgage can give you a better idea of how much you can borrow and can show sellers that you’re a serious buyer. To get pre-approved, you’ll need to provide your lender with some financial information, such as your income, assets, debts, and credit history.

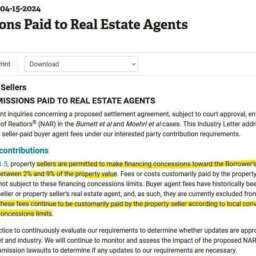

Find a Real Estate Agent

A real estate agent can guide you through the home-buying process, from finding homes within your budget to negotiating with sellers. Look for an agent who is familiar with the area where you want to buy and who has a good reputation. You can ask for recommendations from friends and family, or check online reviews.

View Homes

Now that you have a budget and a real estate agent, it’s time to start looking at homes. Make a list of your must-haves and nice-to-haves in a home, such as the number of bedrooms, bathrooms, and location. Your agent can help you narrow down your search and schedule viewings of potential homes.

Make an Offer

When you find a home that checks off all your boxes, it’s time to make an offer. Your agent can help you determine a fair price based on market trends and comparable properties in the area. They will also guide you through the negotiation process with the seller.

Get a Home Inspection

Before finalizing the purchase of a home, it’s important to get a professional home inspection. This will help uncover any potential issues with the property that may not be visible to the naked eye. Your agent can recommend reputable inspectors and help you navigate through the results.

Closing Process

Once your offer has been accepted and all inspections have been completed, it’s time to close on your new home. Your agent will work closely with you and the seller’s agent to ensure all necessary paperwork is in order and guide you through the closing process.

Buying a home

Buying a home can be an exciting and daunting experience, but having a knowledgeable and experienced real estate agent by your side can make all the difference. They will assist you every step of the way, from determining your budget

Start House Hunting

Once you know your budget and have a real estate agent, you can start looking for a home. Consider factors such as location, size, layout, and amenities. Don’t forget to look beyond the surface and consider potential issues, such as needed repairs or high maintenance costs.

Make an Offer

When you find a home you love, you’ll make an offer. Your real estate agent can help you decide how much to offer based on the home’s value, how long it’s been on the market, and other factors.

Home Inspection and Appraisal

If your offer is accepted, you’ll typically have a home inspection to look for potential issues with the home. Your lender will also order an appraisal to determine the home’s value.

Closing

The final step in the home-buying process is closing. This is when you’ll sign all the paperwork, pay your down payment and closing costs, and get the keys to your new home.

Remember, buying a home is a big decision, and it’s important to take your time and make sure you’re making the best choice for your needs and budget. Your real estate agent is there to guide you through the process and help you find your dream home. Good luck!

Bill Brown

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇