The Impact of Global Events on Real Estate

With the ever-changing landscape of global events, the real estate market is not immune to their effects. Whether it be political upheavals, economic downturns, natural disasters, or health crises like the recent pandemic, the real estate sector is constantly impacted by these external factors. Understanding how global events can influence the market trends, pricing, and demand for properties is crucial for both investors and homeowners alike. In this blog post, we will explore the various ways in which global events can shape the real estate industry and provide insights into how individuals can navigate these challenges effectively.

Economic Influences on Real Estate

Impact of Global Financial Crises

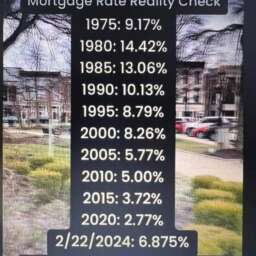

Your real estate investment decisions are significantly influenced by global economic events. The impact of global financial crises on real estate markets cannot be underestimated. Market volatility, credit constraints, and economic uncertainty during crises can lead to a decrease in property values, stalled development projects, and decreased investor confidence.

Foreign Investment Trends

The real estate sector is increasingly affected by foreign investment trends. Foreign capital flow into real estate markets can have a profound impact on property values and market dynamics. Understanding these trends is crucial for navigating the complexities of international investments and for identifying opportunities for growth and diversification.

Financial globalization has opened up opportunities for investors to diversify their portfolios across different countries and asset classes, including real estate. As geopolitical and economic landscapes shift, foreign investment trends in real estate continue to evolve, shaping property markets worldwide.

Understanding Foreign Investment Trends

Foreign investment trends in real estate are influenced by factors such as economic stability, political climate, exchange rates, and regulatory frameworks. As emerging markets become more attractive to foreign investors, understanding these trends can help real estate professionals make informed decisions and capitalize on international opportunities. By staying informed and adapting to changing global investment patterns, investors can effectively navigate the complexities of the real estate market.

Political Events and Real Estate

Effects of Elections and Political Stability

Some of the most significant impacts of political events on the real estate market are seen during elections and periods of political instability. The uncertainty surrounding elections can lead to fluctuations in property prices, with investors adopting a wait-and-see approach. Additionally, political instability can deter foreign investment and cause a decline in property values in affected areas.

Trade Agreements and Cross-Border Policies

The real estate market is closely intertwined with trade agreements and cross-border policies, which can have a direct impact on property values and investment opportunities. Estate transactions can be influenced by changes in trade agreements, tariffs, and policies that affect cross-border investments. Understanding these dynamics is crucial for real estate professionals operating in a globalized market.

Plus, trade agreements can also open up new opportunities for real estate development and investment by promoting economic growth and international partnerships. By staying informed about trade agreements and cross-border policies, real estate professionals can position themselves to take advantage of emerging markets and opportunities.

Environmental and Social Factors

After analyzing the impact of global events on real estate, it becomes evident that environmental and social factors play a crucial role in shaping the industry. From climate change to demographic shifts, these elements heavily influence property values and market trends. Perceiving these factors can help investors and buyers make informed decisions in an ever-changing real estate landscape.

Climate Change and Property Values

Environmental factors, particularly climate change, have a profound impact on property values. Properties in areas prone to natural disasters such as floods, hurricanes, or wildfires often experience a decrease in value due to the associated risks. On the other hand, sustainable properties with green features and energy-efficient systems are becoming increasingly desirable, leading to a rise in their value.

Demographic Shifts and Urbanization

One of the significant social factors influencing real estate is the ongoing demographic shifts and urbanization trends. As populations grow and migrate towards urban areas, the demand for city dwellings and infrastructure increases. This shift not only affects property values but also drives the development of new urban projects and amenities to accommodate the changing needs of residents.

Change in demographics can also impact the types of properties in demand, with a rise in preferences for smaller, more affordable housing options in urban centers. Understanding these shifts is crucial for real estate professionals looking to capitalize on emerging market trends and meet the evolving needs of buyers and renters.

Future Outlook and Preparedness

Anticipating Market Changes

Unlike past global events that caught the real estate market off-guard, it is crucial for industry players to proactively anticipate potential market changes to stay ahead of the curve. By closely monitoring economic indicators, geopolitical shifts, and emerging trends, stakeholders can better prepare for any upcoming shifts in the real estate landscape.

Strategies for Real Estate Investors

For real estate investors looking to navigate the volatile global environment, adopting a diversified investment approach is key to weathering uncertainties. Future-proofing portfolios by incorporating a mix of asset classes, geographic locations, and risk profiles can help mitigate risks and maximize returns in the long run.

Investors should also focus on robust risk management strategies, conduct thorough due diligence, and stay agile in responding to market dynamics to capitalize on emerging opportunities. By staying informed, strategic, and adaptable, real estate investors can position themselves for success in an ever-evolving global landscape.

Final Words

Drawing together the various global events discussed, it is evident that the real estate sector is significantly impacted by factors such as economic crises, natural disasters, and pandemics. These events can lead to fluctuations in property prices, changes in market demand, and shifts in investment preferences. Understanding the influence of global events on real estate is crucial for investors, developers, and policymakers to make informed decisions and mitigate risks. By staying informed, adapting to changes, and implementing strategic planning, stakeholders in the real estate industry can navigate challenges and capitalize on opportunities in an ever-evolving global landscape.

FAQ

Q: What are the key global events that impact real estate markets?

A: The key global events that impact real estate markets include economic downturns, political instability, natural disasters, and global pandemics.

Q: How do economic downturns affect the real estate industry?

A: Economic downturns can lead to decreased consumer confidence, higher unemployment rates, and reduced disposable income, all of which can result in lower demand for real estate properties and decreased property values.

Q: What is the impact of political instability on real estate investments?

A: Political instability can create uncertainty in the real estate market, leading to decreased investor confidence, volatile property prices, and regulatory changes that may affect property ownership and development.

Q: How do natural disasters influence real estate markets?

A: Natural disasters such as hurricanes, earthquakes, and wildfires can damage properties, disrupt housing supply, and impact insurance costs, resulting in decreased property values in affected areas and increased demand in neighboring regions.

Q: What is the effect of global pandemics on the real estate sector?

A: Global pandemics like the COVID-19 outbreak can lead to market volatility, changes in consumer behavior, remote work trends, and shifts in property preferences, impacting commercial real estate sectors such as office spaces, retail properties, and hospitality establishments.

Robert Smith

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇