The Impact of Interest Rates on the Real Estate Market: Interest Rate From Past to 2024

In the intricate dance of economic forces that shape the real estate market, few elements wield as much power as interest rates. For everyone from the seasoned investor navigating a portfolio to the first-time buyer hesitantly stepping into the world of homeownership, understanding the relationship between interest rates and the real estate market is crucial. Join us on a comprehensive exploration of historical trends and contemporary dynamics to appreciate just how fundamentally the ebb and flow of interest rates reshapes the very foundations of real estate activity.

Historical Perspective: The Tug of Low and High Rates on Real Estate

An Early Backdrop of High Rates and Real Estate Stagnation

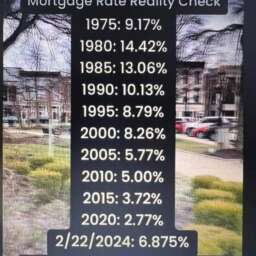

The United States, in the 1980s, was a theater of high interest rates due to Fed actions meant to curb inflation. For the real estate market, this was a period of crisis. Mortgage rates peaked at near 20%, and home values plummeted as buyers’ purchasing power collapsed. The stagnation had ripple effects, permanently altering the landscape of real estate investment.

2008’s Crucible and a Global Financial Crisis

The year 2008 became synonymous with recession, partially sparked by the collapse of the housing sector. Preceded by a borrowing boom fueled by low rates, market imbalances reached a breaking point. The subsequent spike in foreclosure rates and devaluation of properties stands as a stark warning of the destructive potential of interest rate mismanagement.

The Post-Crisis Era: An Atrium for Recovery

In the wake of the global financial crisis, central banks worldwide slashed interest rates to near zero, creating a favorable climate for real estate recovery. Investors could now leverage capital more efficiently, and homebuyers enjoyed record-low mortgage rates. Real estate markets surged, particularly in urban areas, as demand outstripped supply.

Effects on Real Estate Investors: Balancing Acts Beneath the Rates

Fluctuations as Timekeepers of Investment Strategies

Interest rate movements are pivotal for real estate investors, often serving as the beating heart of their financial strategies. As rates drop, the allure of leverage grows, encouraging more aggressive investment tactics. Conversely, rising rates may advocate a more conservative approach, favoring equity financing and emphasizing cash flow stability over rapid expansion.

Property Values: The Seesaw of Low and High Rates

Low interest rates typically signal higher property demand as they reduce the cost of borrowing, leading to an uptick in property values. When rates rise, so do financing costs, potentially cooling the market and exerting downward pressure on property prices as capital becomes more costly and, thus, less accessible.

The Agitated Ripples Across Financing Costs

Interest rates directly correlate with the cost of financing, influencing everything from mortgage payments to commercial property loans. In a high-rate environment, the burden of financing can temper investors’ appetite for acquisitions, while in a low-rate context, the appeal of cheap capital often leads to an increase in leverage and, subsequently, the acquisition of more substantial assets.

Implications for Economists: Examining Key Indicators and Yield Curves

Interest Rates as a Bellwether for Economic Growth

Economists closely monitor interest rate movements as a predictive lens into the future of real estate. Higher rates can signify a tightening monetary policy and, by extension, a cooling economy. Conversely, lower rates might suggest the stimulus of cheaper credit intended to invigorate growth.

Yield Curves and Their Portents for Real Estate Cycles

The yield curve – the graphical depiction of interest rate return on investments with differing maturities – often portends economic recession when it inverts, and long-term rates fall below short-term rates. For the real estate market, an inverted yield curve can presage falling demand and, potentially, a downturn in property prices due to expected economic contraction.

Capital Flows in a Rate-Driven Real Estate Landscape

The flow of capital within the real estate market is significantly influenced by interest rates. When rates are low, debt investments tend to be more attractive due to higher returns compared to conservative fixed-income assets. Conversely, high rates may lead to a shift toward equity investments, favoring real estate trusts and direct property ownership.

Considerations for Home Buyers: The Melody of Affordability

Interest Rates as the Pivot of Home Affordability

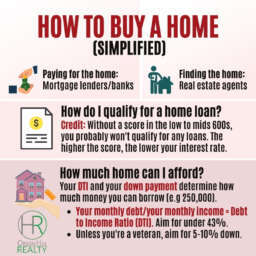

The central role of interest rates in determining home affordability cannot be overstated. As rates fall, the cost of borrowing decreases, and homebuyers can afford more expensive properties with the same monthly mortgage payment. When rates rise, the converse occurs, often limiting the purchasing power of buyers and contracting the market.

The Mortgage Market Symphony: Fixed vs. Adjustable Rates

Fixed-rate mortgages offer the security of unchanging monthly payments, shielding borrowers from fluctuations that come with interest rate changes. Adjustable-rate mortgages (ARMs), on the other hand, offer lower initial rates that adjust periodically, making them potentially more affordable in a low-rate environment but riskier when rates begin to climb.

Psychological Changes and Their Bearing on the Market

Interest rate changes can significantly alter the psychology of homebuyers. Low rates often fuel a sense of urgency to buy, lest one miss the window of opportunity for affordable financing. Higher rates, meanwhile, may prompt more careful consideration and longer search times as buyers adjust their expectations to their new financial reality.

Impact on Home Sellers: Market Forces Unleashed by Rates

Demand Flux as Rates Undulate

Interest rates have a direct bearing on the level of demand in the housing market. Lower rates generally mean more buyer activity as they can afford larger mortgages, leading to a seller’s market with increased competition and potential for higher sale prices. Higher rates can conversely dampen demand and shift the market in favor of buyers, potentially leading to a rise in inventory and a stabilization or reduction of prices.

The Dance Between Rate Cycles and Selling Strategies

In a market characterized by low interest rates, sellers might strategize to capitalize on the high demand and potential for bidding wars. Alternatively, when rates are high, sellers may need to adjust their pricing to align with the market’s reduced purchasing power, or be prepared for a longer listing period as buyers are more selective and may negotiate harder on price.

Recognizing the Ripple Effect on Home Values

Interest rate movements can have a ripple effect on home values. A shift to higher rates typically increases the cost of borrowing, which can reduce the number of potential buyers in the marketplace. This reduction in demand can lead to a softening of home values, as sellers may need to adjust pricing to attract a smaller pool of available buyers.

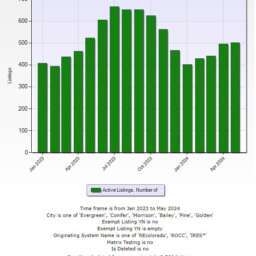

Current Market Scenario: Interest Rates as Real-Time Movers

Pandemic-Driven Volatility and the Stance of Central Banks

The COVID-19 pandemic has led to unprecedented levels of volatility in both financial and real estate markets. Central banks responded with aggressive rate cuts to stabilize the economy, leading to a surge in home refinancing and buying activity. As economic recovery gains traction, the trajectory of interest rates will be instrumental in shaping the real estate market in the post-pandemic world.

The Taming of Inflation and Its Influence on Real Estate

Inflationary pressures can lead to upward interest rate adjustments as central banks intervene to curb rising consumer prices. For the real estate market, higher rates can mean reduced purchasing power for consumers, potentially cooling the market and mitigating against inflated property values that often accompany periods of rapid inflation.

Strategic and Tactical Shifts in a Fluid Market Environment

Real estate professionals must remain adaptable in a market sensitive to interest rate changes. A rising rate environment may necessitate a shift in marketing strategies to appeal to price-conscious buyers, while a steady or declining rate landscape can inspire confidence and support long-term investment in properties with appreciation potential.

The Unbreakable Link Between Rates and Real Estate

In the vast tapestry of the real estate market, interest rates are the weaver, threading together the fortunes of investors, buyers, sellers, and economists alike. Their impact is omnipresent, influencing everything from investment horizons to mortgage terms, and dictating market conditions that can persist for years. As we stand on the cusp of a new economic era, understanding and interpreting the cadence of interest rates is not just prudent – it is essential for those seeking to thrive in this ever-evolving industry.

Robert Davis

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇