The Power of LinkedIn: My Comprehensive Guide to Importing CSV Databases for Real Estate Capital Raising

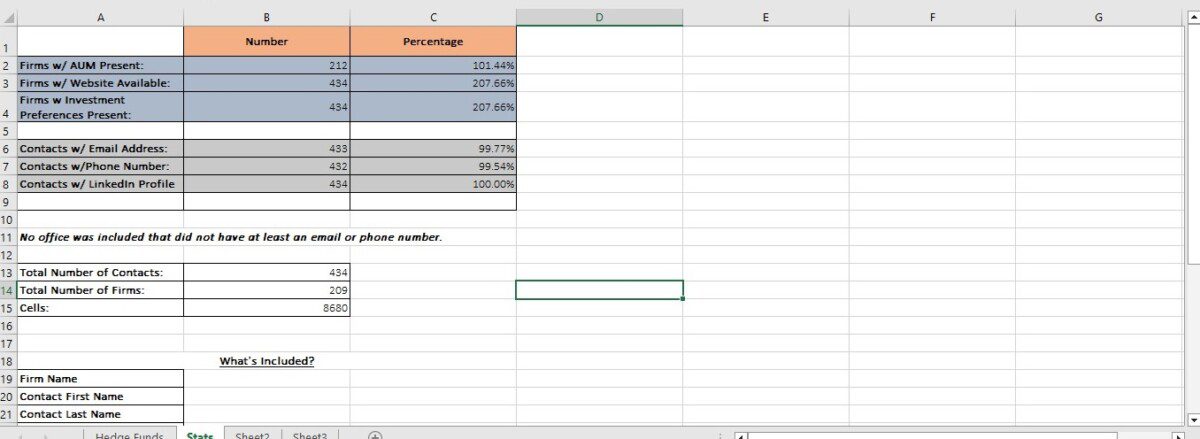

I have 9,000 plus contacts at hedge funds, family offices and lenders. I can layout a strategy for anyone using these and Linked In in formulating not just a capital raising or fundng program but also a credibility, awareness and branding strategy.

LinkedIn has evolved into a powerful platform for professionals to connect, network, and explore business opportunities. One effective way to leverage LinkedIn for real estate investing is by importing databases from comma-separated values (CSV) files. In this article, we will guide you through the process of importing CSV databases and then demonstrate how to utilize your connections to formulate a strategic plan for raising capital in the real estate sector.

Step 1: Build a Strong LinkedIn Profile

Before diving into importing databases, ensure that your LinkedIn profile is polished and professional. Highlight your real estate experience, skills, and achievements. A well-crafted profile not only attracts potential investors but also establishes credibility within the industry.

Step 2: Gather and Organize Your CSV Database

Compile a CSV file with relevant contacts, including potential investors, industry professionals, and colleagues. Ensure that your database includes key information such as names, positions, companies, and email addresses. Organize the data to make it easily manageable once imported.

Step 3: Importing CSV Database to LinkedIn

- Navigate to Connections: On your LinkedIn homepage, click on the “My Network” tab.

- Import Connections: In the “My Network” section, you’ll find the “Connections” tab. Click on the “Add Connections” button.

- Choose File: Select the “Any email” option and click on “Choose File” to upload your CSV database.

- Verify Connections: LinkedIn will attempt to match the contacts in your CSV file with existing LinkedIn profiles. Review and confirm the matches.

- Send Connection Requests: Once verified, send connection requests to the matched contacts. Personalize your invitations to enhance the likelihood of acceptance.

Step 4: Engage and Nurture Connections

- Regularly Post Content: Share insightful content related to real estate investing. This keeps you visible in your network’s feed and positions you as a knowledgeable professional.

- Engage with Others: Comment on and share content from your connections. Building a genuine relationship on the platform is crucial for trust and credibility.

Step 5: Formulate a Capital Raising Strategy

- Identify Potential Investors: Leverage your newly expanded network to identify individuals interested in real estate investment. Use advanced search filters to find connections with specific investment interests.

- Direct Messaging: Once identified, initiate direct messages with personalized introductions. Clearly communicate your real estate investment opportunities and the potential benefits for investors.

- Host Webinars and Events: Utilize LinkedIn Events to host webinars or virtual events focused on real estate investing. This provides a platform to showcase your expertise and connect with potential investors.

Step 6: Nurture Long-Term Relationships

- Provide Value: Continue to share valuable content and insights. Regularly update your connections on your real estate projects, successes, and market trends.

- Ask for Referrals: Encourage satisfied investors to refer you to their network. Word-of-mouth recommendations can be a powerful catalyst for raising capital.

Conclusion:

By importing CSV databases and strategically utilizing LinkedIn connections, real estate professionals can significantly enhance their ability to raise capital. Remember, success on LinkedIn is not just about quantity but also about the quality of your relationships. Building a strong, engaged network will open doors to valuable opportunities in the real estate investment landscape.

Nate Marshall

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇