Exploring the Benefits of USDA Home Loans in the Sunshine State

For many aspiring homeowners, the prospect of buying their first home in Florida can seem daunting, given the state’s reputation for luxurious coastal living and fluctuating housing market prices. The dream of owning a home often feels slightly out of reach, particularly when faced with the state’s challenging real estate dynamics, where property costs can significantly outpace average incomes. However, the introduction of USDA Home Loans presents a viable solution, offering a guiding hand to navigate the complex journey towards homeownership in Florida’s vibrant landscape.

USDA Home Loans emerge as a critical tool for prospective homeowners in Florida, aiming to bridge the gap between the dream of homeownership and its realization. Backed by the federal government, these loans are designed to bolster rural development and improve the quality of life in less densely populated areas. They provide a lifeline to moderate and low-income individuals by offering 100% financing, a boon in a state where real estate prices can be prohibitively high. This program not only facilitates access to homeownership but also promotes economic stability and growth in Florida’s rural and suburban communities.

Eligibility for USDA Home Loans is notably more accessible compared to traditional mortgage options, tailored to support individuals and families who might otherwise find the path to homeownership blocked by financial constraints. This inclusivity is particularly beneficial in Florida, where diverse rural and suburban areas abound. The program’s focus on no down payment requirements and favorable loan terms makes homeownership a tangible goal for a broader spectrum of the population. By addressing the unique needs of Floridians, USDA Home Loans play a pivotal role in enabling residents to secure a piece of the Sunshine State, whether near its famed coastlines or within its burgeoning suburban landscapes.

For many first-time homebuyers, the idea of stepping into the realm of homeownership can seem like a dream just out of reach, especially in a state known for its coastal extravagance like Florida. ‘Sunshine State’ might evoke images of sand and surf, but the marketplace here can be as capricious as the tropical weather, with housing prices often dancing out of sync with the average income.

In comes USDA Home Loans, like a trusted co-pilot helping navigate the sometimes stormy journey to homeownership, to our rescue. The United States Department of Agriculture (USDA) offers this program to support moderate to low-income borrowers in acquiring a residence in eligible rural areas. This comprehensive guide will walk you through the lush landscape of USDA home loans specifically tailored to the unique needs of Floridians and those wishing to set down roots in this beautiful southern haven.

USDA Home Loans: A Glimpse of the Big Picture

Understanding what lies at the heart of USDA home loans is crucial for anyone setting sights on long-term residency, particularly in Florida. These loans are backed by the federal government and are part of its commitment to improving the economy and quality of life in rural America. The benefits are as plentiful as they are purpose-driven, assisting the dreams of many who aim to stabilize and grow their personal estates.

An Overview of the Program

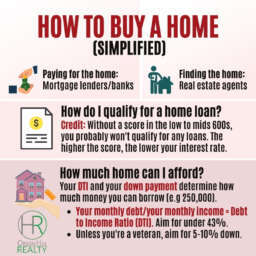

USDA home loans stand out with their offering of 100% financing, allowing buyers to move in with little to no money down, an impressive proposition in a state with property market values that can rival tropical paradises worldwide.

The program is engineered to offer affordable and sustainable home ownership opportunities, ensuring the stability of the housing market in rural and suburban areas. This is a beacon for first-time homebuyers who may struggle with hefty down-payments or competitive housing markets.

Who’s Eligible and Why it Matters

Eligibility criteria for the USDA Home loan are considerably more flexible than standard mortgage products. Income limits vary from region to region but generally cap at 115% of the median income in that area. The lack of a substantial down payment requirement coupled with liberal credit thresholds means that it’s not just a nebulous dream — it’s a tangible reality even for those who might have been previously deterred by stringent lending practices.

The Florida-Focused Flourish of USDA Home Loans

Florida’s real estate landscape is as diverse as the inhabitants who call it home. From rolling citrus groves to vast coastal stretches and burgeoning suburbs, the potential for home buyers to find their slice of Florida life is rich. What’s even more enticing is how USDA home loans cater to the specific needs and nuances of Florida’s market.

What’s in it Specifically for Floridians?

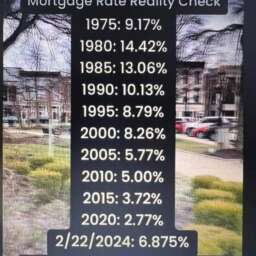

In a state that boasts its fair share of rural and suburban regions, the geographical reach of USDA home loans is a match made in heaven. Some of the most attractive facets for Florida dwellers include the assistance in avoiding mortgage insurance premiums, competitive interest rates, and the security of a 30-year fixed-rate mortgage, providing stable and predictable payments.

Making Waves with USDA Loans along the Coasts

For those drawn to Florida’s coastal charms, the USDA program extends its grasp to communities that are often overlooked by other loan programs. Aspiring homeowners in places like the beaches of the Atlantic or the Gulf can find a pathway to their home sweet home where the sea breeze mingles with the satisfaction of owning a place of their own.

Bridging the Gap in Florida’s Burgeoning Burbs

With burgeoning suburbs offering a higher standard of living coupled with a family-friendly environment, USDA loans offer a financial bridge. For families dreaming of their own backyard within driving distance of urban conveniences, the program curtails the financial strain often associated with the leap to suburbia.

Mastering the Art of Applying for a USDA Home Loan in Florida

The quest to score a USDA home loan in Florida is more than possible; it’s a potential game-changer. The application process is the first leg of the journey, and arming yourself with knowledge and preparation can make all the difference.

Navigating the Application Process with Finesse

Preparation is key when applying for a USDA home loan, as stringent documentation is required to support the application. Guidance, here, is indispensable — securing a loan officer experienced with the intricacies of the USDA process is akin to ensuring a favorable wind for your fiscal sails.

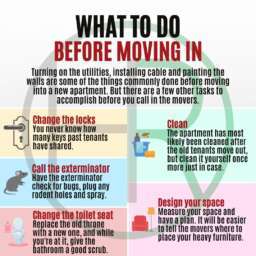

Real Estate Realities: Finding a Home That Qualifies

Florida’s cornucopia of housing options can be a maze to navigate, but with USDA loans, choosing an eligible property is more straightforward. Homes in designated rural and certain suburban areas qualify, transforming unconventional living spaces into revered corners of a hopeful homeowner’s life.

Success Stories and Words of Wisdom: Testimonials and Tips

The most effective testimony to the value of a program like USDA home loans comes from those who have successfully made it through the process.

Illuminating Florida Homeownership Dreams: Real-Life Stories

Real-life success stories highlight the transformative power of USDA home loans. From the joy of holding a set of keys to the freedom of personalized living, these stories resonate with the inspired homeowner-to-be.

Invaluable Insights: Tips for Tweaking Your Application

The landscape of mortgage applications can be daunting, yet with a few savvy maneuvers, applicants can tilt the odds in their favor. Simple strategies can sway the pendulum from uncertainty to confidence.

Seizing the Sunshine: Embracing USDA Home Loans in Florida

Florida’s allure can be felt from its sandy shores to the quiet pastures, and USDA home loans offer a route to tether your roots to the soil. The benefits are not just financial; they are the stepping stones towards stability, growth, and a true place to call home.

Recap of the Radiant Perks of USDA Home Loans

Florida residents and prospective homebuyers have a clear advantage in USDA home loans. The program is a beacon for those looking to secure their future with sound financial decisions without the weighty burdens that often accompany traditional mortgages.

The Path is Bright and Clear

If you’re envisioning a future in Florida’s coastal calm or rural charm, a USDA home loan could be the catalyst for your move. Take that vital step towards claiming your own parcel of the Sunshine State. The journey may seem long, but with the support of USDA home loans, the endpoint — your very own home — is well within reach.

With a commitment to excellence and a passion for empowering homeowners, USDA home loans are the gateway to the life you’ve imagined in Florida. Let the beams of the Sunshine State light your path through the doors of your very own abode.

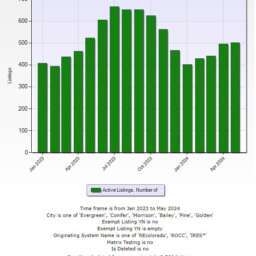

Southwest Florida Homes for Sale

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇