Understanding Discount Points in Mortgage Financing

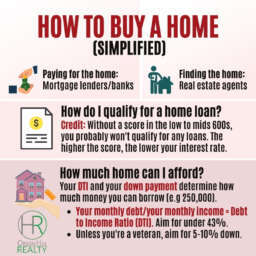

When navigating the path to homeownership, one of the critical decisions you’ll face is whether to pay for discount points. Discount points, often simply called “points,” are a form of prepaid interest that can help you secure a lower interest rate on your mortgage. This concept might seem straightforward at first glance, but it involves a nuanced understanding of your financial situation and long-term housing plans. This article will delve into what discount points are, how they work, and provide an example to illustrate their impact on a mortgage for a $250,000 home.

What Are Discount Points?

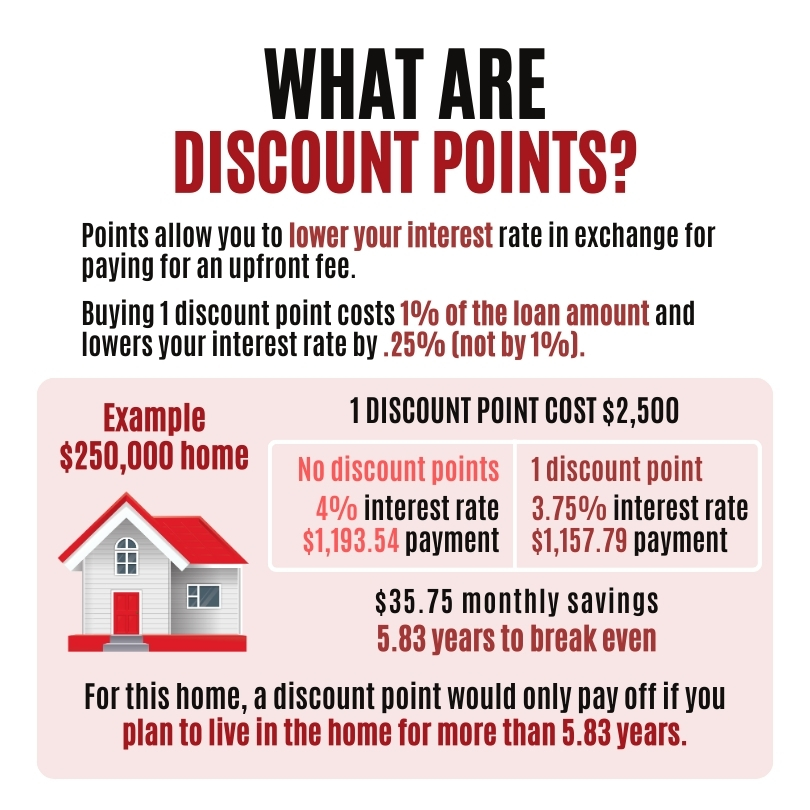

Discount points are upfront fees paid to the lender at closing to reduce the interest rate on your mortgage loan. Essentially, you’re paying part of your interest upfront in exchange for a lower rate throughout the life of the loan. One discount point is equal to 1% of the loan amount. Therefore, if you’re taking out a $250,000 mortgage, one point would cost you $2,500.

The reduction in interest rate achieved by purchasing discount points is not fixed but typically hovers around 0.25% per point. However, the exact amount can vary depending on the lender, the loan program, and market conditions.

How Do Discount Points Work?

The mechanism behind discount points is based on the principle of prepaid interest. By paying upfront, borrowers can secure a lower interest rate, which translates into lower monthly mortgage payments. This option can be particularly appealing for homeowners who plan to stay in their homes for a long time, as the savings on interest over the years can significantly outweigh the initial cost.

The Impact of Buying Discount Points

Let’s consider a practical example with a $250,000 home purchase:

- Without Discount Points:

- Interest Rate: 4%

- Monthly Payment: $1,193.54

- With 1 Discount Point:

- Cost of Point: $2,500 (1% of the loan amount)

- New Interest Rate: 3.75%

- New Monthly Payment: $1,157.79

- Monthly Savings: $35.75

In this scenario, by spending $2,500 upfront, the homeowner reduces their monthly payment by $35.75. To determine whether this is a financially sound decision, one must calculate the break-even point — the moment when the upfront cost of the discount point is fully recouped through monthly savings.

Calculating the Break-Even Point

The break-even point is calculated by dividing the cost of the discount point by the monthly savings. In our example:

- Break-Even Point: $2,500 / $35.75 ≈ 69.9 months or approximately 5.83 years

This means that it would take nearly 6 years for the savings from the lower interest rate to offset the initial $2,500 investment. Therefore, buying a discount point in this case makes financial sense if you plan to live in the home for more than 5.83 years. If you sell the home or refinance your mortgage before this time, you may not recoup the cost of the points.

To Buy or Not to Buy?

The decision to buy discount points should hinge on several factors:

- Length of Ownership: If you anticipate moving or refinancing before reaching the break-even point, paying for points might not be cost-effective.

- Financial Capacity: Evaluate whether you have the upfront cash required to pay for points, keeping in mind closing costs and other moving expenses.

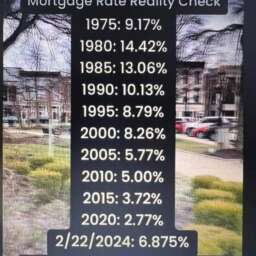

- Interest Rate Environment: In a low-interest-rate environment, the savings might be less compelling, especially if rates are expected to drop further.

FAQs

Q: Are discount points tax-deductible?

A: Yes, discount points are generally tax-deductible, but it’s always best to consult with a tax advisor to understand how this applies to your specific situation.

Q: Can discount points be financed?

A: In some cases, yes. However, financing the points increases your loan amount and may affect your loan-to-value ratio, potentially leading to higher costs elsewhere.

Q: Is there a limit to how many points I can buy?

A: Lenders typically have limits on the number of points you can purchase, often based on the loan type and your specific financial situation.

Discount points can offer a way to save on interest over the life of your mortgage, but they’re not universally beneficial. Careful consideration of your long-term plans, financial health, and the specifics of your loan offer is crucial before making a decision. Understanding the intricacies of discount points can lead to significant savings and a more manageable mortgage in the long run.

Grace Wright

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇