Fix and Flip for Real Estate 101: A Comprehensive Guide for Investors

Fix and Flips for Investment

The allure of fix and flip projects lies in their potential for quick profit, offering an exciting venture for real estate investors with an eye for value and a knack for renovation. This guide provides a foundational overview for those interested in venturing into the fix and flip realm, outlining key strategies, risks, and rewards associated with these types of real estate investments.

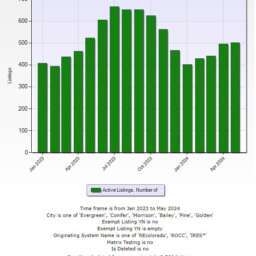

- Market Research: Thoroughly understand local real estate trends and identify undervalued properties with high potential for profit.

- Financial Planning: Secure funding through savings, loans, or investors, and budget accurately for purchase, renovation, and unforeseen costs.

- Property Selection: Focus on properties that require cosmetic updates rather than major structural repairs to maximize return on investment.

- Assessing Value: Evaluate the after-repair value (ARV) of a property to ensure a healthy profit margin post-renovation.

- Efficient Renovations: Plan renovations that add the most value with the least cost, focusing on improvements that enhance curb appeal and interior appeal.

- Hiring Contractors: Choose experienced contractors with proven track records; obtain multiple bids to ensure competitive pricing.

- Time Management: Aim to complete renovations and sell the property as quickly as possible to reduce holding costs and maximize profits.

- Marketing Strategy: Use effective marketing techniques, including professional staging and listing on popular real estate platforms like Orson Hill Realty, to attract buyers.

- Pricing Strategy: Price the property competitively based on the local market and the home’s upgraded features to facilitate a quick sale.

- Risk Management: Prepare for potential setbacks with a contingency budget and stay informed about market changes that could affect the sale.

What is Fix and Flip?

Fix and flip involves purchasing properties at a lower market price, renovating them to increase their value, and then selling them for a profit. This investment strategy requires a combination of market knowledge, renovation skills, and timing to achieve success.

Step 1: Market Research

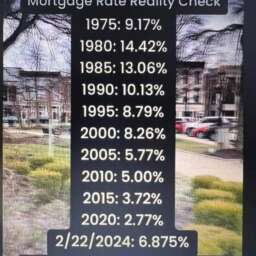

Before diving into your first project, understanding the real estate market is crucial. Researching the local market trends, property values, and consumer preferences in your area can help you identify promising properties and neighborhoods. Tools and resources like MLS listings, real estate websites like Orson Hill Realty, and local property records can provide valuable insights.

Identifying the Right Property

Look for properties that are priced below market value due to cosmetic issues, minor wear and tear, or other factors that don’t affect the structural integrity of the home. These are ideal candidates for a fix and flip project.

Step 2: Financing Your Project

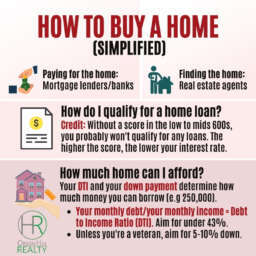

Securing funding is a critical step in the fix and flip process. Options include cash savings, bank loans, hard money lenders, or private investors. Each financing method comes with its own set of pros and cons, and it’s essential to choose one that aligns with your investment strategy and financial capacity.

Step 3: Renovation and Value Addition

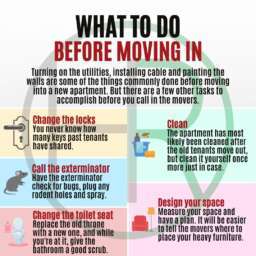

Successful flipping requires a well-thought-out renovation plan that adds significant value to the property without overcapitalizing. Focus on improvements that increase curb appeal, enhance the functionality of the house, and are in line with buyer preferences in the area. Hiring experienced contractors and getting multiple quotes can help in executing the renovation efficiently and cost-effectively.

Step 4: Selling the Property

Once the property is renovated, the next step is to list it for sale. Effective marketing strategies, including online listings on platforms like Orson Hill Realty and engaging staging techniques, can help attract potential buyers. Pricing the property correctly is crucial to selling quickly and making a profit.

Risks and Challenges

While fix and flip projects can be lucrative, they also come with risks. Unexpected renovation costs, changes in the real estate market, and longer-than-anticipated selling times can impact profitability. Conducting thorough due diligence before purchasing a property and maintaining a contingency fund for unforeseen expenses can help mitigate these risks.

Fix n Flips

Fix and flip projects offer a unique opportunity for real estate investors to leverage their market knowledge and renovation skills for potential profit. However, success in this venture requires careful planning, diligent research, and a strategic approach to renovation and sale. By understanding the fundamentals outlined in this guide, aspiring investors can navigate the fix and flip process more confidently and efficiently.

FAQ

What is the most important factor to consider when selecting a property to fix and flip?

The most important factor to consider when selecting a property for a fix and flip project is its potential for value appreciation post-renovation, often determined by the property’s location and purchase price. A desirable location in a stable or up-and-coming neighborhood can significantly increase the property’s appeal to potential buyers, contributing to a higher selling price. The purchase price also plays a critical role; acquiring the property at a price that allows for renovation costs and a healthy profit margin is essential. Investors should conduct thorough market research, including comparative analysis of recent sales in the area, to identify properties that meet these criteria.

Additionally, the property’s condition and the extent of required renovations are crucial. Properties that need cosmetic updates tend to offer a quicker turnaround and potentially higher ROI compared to those requiring extensive structural repairs. Investors should have the property inspected by professionals to identify potential issues and estimate renovation costs accurately. This assessment helps in making informed decisions, ensuring the project remains viable and profitable.

How do you accurately budget for a fix and flip project?

Accurately budgeting for a fix and flip project involves a detailed analysis of all potential costs, including the purchase price, renovation expenses, holding costs (like insurance, utilities, and property taxes), and selling costs (including agent commissions and closing fees). Start by evaluating the property’s after-repair value (ARV) to determine your potential selling price, then subtract your desired profit margin to set your total project budget. From this figure, deduct estimated renovation costs, purchase-related expenses, and holding costs to arrive at the maximum purchase price you can afford.

Renovation budgeting should be detailed, factoring in both labor and materials for each aspect of the project. It’s advisable to obtain quotes from multiple contractors to ensure competitive pricing and to include a contingency fund of at least 10-20% of the total renovation budget to cover unexpected expenses. Keeping the renovations in line with what’s desirable in the local market while avoiding overcapitalization is key. Regularly reviewing and adjusting the budget as the project progresses can help prevent overspending, ensuring the project stays on track financially.

How long does it typically take to complete a fix and flip project?

The timeline for a fix and flip project can vary widely based on several factors, including the scope of renovations required, the efficiency of your contractors, and the current real estate market conditions. Generally, a typical project might take anywhere from 4 to 12 months from purchase to sale. The renovation phase usually consumes the most time, with projects requiring only cosmetic updates taking a few weeks to a couple of months, while more extensive remodels can take several months to complete.

Efficient project management is critical to minimizing the timeline. This includes promptly obtaining necessary permits, sourcing materials, and scheduling contractors. Additionally, market conditions will influence the selling phase’s duration; in a seller’s market, properties may sell quickly, while in a buyer’s market, it might take longer to find a buyer at the desired price point. Investors should prepare for variability in the timeline and have a financial buffer to cover holding costs if the project extends longer than anticipated.

What are the most common mistakes in fix and flip projects?

One common mistake in fix and flip projects is underestimating the cost and scope of renovations needed. This can lead to budget overruns and reduced profit margins. Investors should conduct thorough inspections prior to purchase and consult with experienced contractors to obtain accurate renovation estimates. Additionally, creating a detailed project plan and budget, including a contingency fund for unexpected expenses, can help mitigate this risk.

Another mistake is overlooking the importance of understanding the local real estate market. Investing in a property without researching the neighborhood, local demand for housing, and comparable property values can result in overpricing and prolonged selling times. Successful flippers tailor their renovations to match local buyer preferences and price their properties competitively, ensuring they appeal to the target market and sell quickly.

Can beginners successfully undertake fix and flip projects?

Yes, beginners can successfully undertake fix and flip projects, but success requires careful planning, education, and a willingness to seek advice from experienced professionals. New investors should start by thoroughly researching the real estate market, understanding the financial aspects of flipping, and learning about the renovation process. It’s also beneficial to network with real estate agents, contractors, and other flippers to gain insights and advice.

Beginning with a project that requires minimal to moderate renovations can help mitigate risks associated with more extensive projects. Additionally, working with a mentor or partnering with an experienced investor for the first few projects can provide valuable on-the-ground learning opportunities. Continuous learning, adaptability, and a careful approach to budgeting and project selection are key factors in navigating the challenges of fix and flip investments as a beginner.

Q: How much should I budget for renovations? A: The budget for renovations will vary significantly depending on the property’s condition and the market’s demands. Generally, it’s wise to allocate at least 20% to 30% of the property’s purchase price for renovations, but this can vary widely.

Q: How long does a typical fix and flip project take? A: The timeline for a fix and flip project can vary from a few months to over a year, depending on the extent of renovations required and the time it takes to sell the property. Aiming for a timeline of 6 to 12 months for the entire process is a good rule of thumb.

By integrating a strategic approach and thorough market research, investors can navigate the complexities of fix and flip investments, making informed decisions that lead to successful outcomes.

Robert Smith

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇