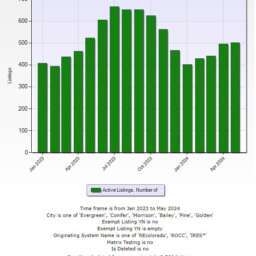

Navigating the Waters of Mortgage Interest Rates: A 2023-2024 Overview

The landscape of mortgage interest rates has been a rollercoaster over the past year, with rates reaching a 23-year high in 2023 before showing signs of stabilization as we step into 2024. This article delves into the fluctuations of mortgage rates, offering insights into their past trends, current status, and future predictions, providing a comprehensive understanding for potential homebuyers and homeowners considering refinancing.

The Surge of 2023: A Record High

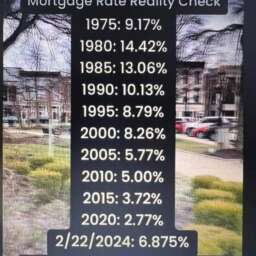

The year 2023 witnessed a significant spike in mortgage interest rates, peaking at an astonishing 7.8% in November, marking the highest point in over two decades. This dramatic increase was primarily fueled by the Federal Reserve’s aggressive stance against the rampant inflation of 2022, aiming to cool down the overheated housing market and, by extension, the broader economy.

The Cooling Phase: A Gradual Decline

As we moved into 2024, the fever pitch of mortgage rates began to show signs of easing. By late March, the average 30-year fixed mortgage rate had slightly decreased from 6.87% to 6.79%. This moderation reflects a broader economic adjustment, with inflation beginning to cool and the Federal Reserve altering its policies by pausing rate hikes, with cuts anticipated later in the year. The expectation is that as the economy continues to show signs of slowing, mortgage interest rates will follow a downward trajectory.

The Federal Reserve’s Strategy: From Hikes to Cuts

In a pivotal shift, the Federal Reserve is expected to commence rate cuts starting from the May 2024 meeting. This move is anticipated to lower the federal-funds rate target range from its current 5.25%-5.50% to 4.00%-4.25% by the end of 2024. The strategy behind these cuts is to support economic growth as inflation returns to the Fed’s 2% target. Predictions also suggest that the 30-year mortgage rate will fall to 5.0% in 2025 from an average of 6.8% in 2023.

The Outlook for 2024 and Beyond

Looking ahead, the mortgage rate landscape in 2024 appears to be one of gradual decline and stabilization. This outlook is underpinned by the cooling of inflation, the Federal Reserve’s adjusted policy stance, and the economy’s overall adjustment to post-pandemic conditions. For potential homebuyers and those considering refinancing, this could present opportunities as rates begin to stabilize and eventually decrease, although the timing and extent of these changes will be closely tied to ongoing economic conditions and policy decisions.

What This Means for Homebuyers and Homeowners

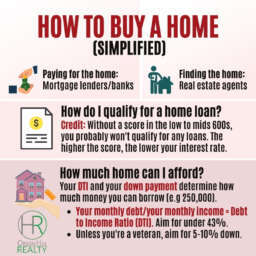

For individuals in the market to buy a home or refinance their mortgage, the current climate presents a mix of challenges and opportunities. While rates remain higher than the historic lows seen in 2020 and 2021, the expected reductions in the coming months could provide a more favorable environment for securing a mortgage. It’s crucial for potential borrowers to stay informed of rate trends and work closely with financial advisors to time their mortgage applications optimally.

A Future of Opportunities

As we navigate through 2024, the mortgage interest rate environment is poised for changes that could benefit both homebuyers and those looking to refinance. By understanding the factors driving rate fluctuations and staying abreast of the Federal Reserve’s policy shifts, individuals can make informed decisions that align with their financial goals and take advantage of the evolving market conditions.

Chloe Hill

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇