Investing In Rental Properties – A Investor’s Guide To Real Estate

This comprehensive guide is designed to provide aspiring real estate investors with the important knowledge and strategies needed to succeed in the competitive rental property market. Investing in rental properties can offer lucrative returns, tax benefits, and opportunities for long-term wealth accumulation. However, it is crucial to approach this type of investment with caution and an understanding of the potential risks involved. From finding the right property and financing options to tenant management and maximizing rental income, this guide covers all the key aspects of real estate investing to help you make informed decisions and navigate the complexities of the market with confidence. Whether you are a beginner looking to dip your toes into real estate investing or a seasoned investor seeking to expand your portfolio, this guide will equip you with the knowledge and tools needed to achieve success in the rental property market.

Key Takeaways:

- Diversification: Investing in rental properties can help diversify your investment portfolio and reduce risk.

- Passive Income: Rental properties can provide a steady stream of passive income through rental payments from tenants.

- Appreciation: Over time, rental properties have the potential to appreciate in value, allowing investors to build equity and wealth.

Types of Rental Properties

The types of rental properties that you choose to invest in can have a significant impact on your overall real estate investment strategy. Understanding the different categories of rental properties available can help you make informed decisions and maximize your returns. Here are some common types of rental properties:

| Single-Family Homes | Multi-Family Dwellings |

| Vacation Rentals | Commercial Properties |

Single-Family Homes

To invest in single-family homes means purchasing residential properties that are designed to house one family. These properties are typically easier to manage for beginner investors, as they only have one set of tenants to deal with. Single-family homes are also popular among long-term tenants looking for a stable living environment.

Single-family homes often offer steady cash flow and appreciate over time, making them a reliable investment choice for those looking for a low-risk entry into the real estate market.

Multi-Family Dwellings

With multi-family dwellings, investors purchase buildings that house multiple tenants or families. This type of rental property can provide multiple income streams from different units within the same building. Multi-family dwellings also offer economies of scale, as maintenance and management costs can be spread across multiple units.

This type of rental property requires a more hands-on approach to management, as you will be dealing with multiple tenants and units. However, the potential for higher cash flow and increased property value can make it a lucrative investment option for experienced real estate investors.

This type of rental property can be a good option for investors looking to diversify their portfolio and increase their income potential. With careful management and maintenance, multi-family dwellings can provide a reliable source of passive income over the long term.

Vacation Rentals

One popular option for rental properties is vacation rentals, where investors purchase properties in desirable vacation destinations to rent out to short-term tenants. Vacation rentals can offer higher rental income during peak seasons, but they also come with the challenge of managing turnover between guests regularly.

It is vital to consider factors such as location, seasonality, and tourism trends when investing in vacation rentals. With the right strategy and marketing, vacation rentals can be a profitable investment that provides both rental income and potential for property appreciation.

Commercial Properties

Properties such as office buildings, retail spaces, and industrial warehouses fall under the category of commercial properties. Investing in commercial properties can offer higher rental income and long-term lease agreements compared to residential properties. Commercial properties also tend to have longer lease terms, reducing the frequency of tenant turnover.

Vacation rentals offer the potential for significant appreciation and can attract quality tenants such as businesses and corporations. However, investing in commercial properties requires a greater initial capital investment and a higher level of knowledge about the commercial real estate market.

Step-by-Step Guide to Investing in Rental Properties

Keep in mind that investing in rental properties can be a lucrative venture, but it requires careful planning and research to ensure success. To help you navigate through the process, here is a step-by-step guide that will walk you through the necessary aspects of investing in rental properties.

| Researching the Market | Financial Planning and Budgeting |

| An important first step in investing in rental properties is to research the market thoroughly. Understanding the local rental market trends and analyzing vacancy rates, rental prices, and demand will help you make informed decisions about where to invest. | On the financial side, it’s crucial to establish a solid budget for your investment. Calculate all potential costs, including property taxes, maintenance expenses, mortgage payments, and property management fees to determine if the investment aligns with your financial goals. |

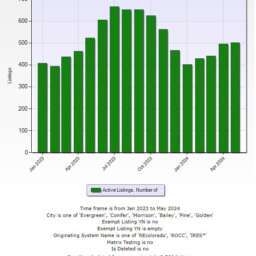

Researching the Market

When researching the market, consider factors such as neighborhood amenities, proximity to schools and transportation, and the overall economic outlook of the area. Conducting thorough research will help you identify properties with high rental potential and long-term appreciation.

Additionally, networking with local real estate professionals and attending property auctions or open houses can provide valuable insights into the market and help you stay ahead of the competition.

Financial Planning and Budgeting

Step-by-step financial planning is necessary to ensure that your rental property investment is financially viable in the long run. Creating a detailed budget will help you forecast potential cash flow, analyze risks, and make informed decisions about your investment strategy.

Moreover, consulting with a financial advisor or a real estate investment expert can provide you with additional guidance on structuring your finances and maximizing the returns on your investment.

The Property Search

Planning your property search involves setting clear investment goals, outlining your criteria for property selection, and conducting thorough property inspections to assess the condition of potential rental properties. This will help you narrow down your options and make informed decisions.

Rental property listings, real estate websites, and working with local real estate agents are effective ways to find suitable properties that meet your investment objectives and budget constraints.

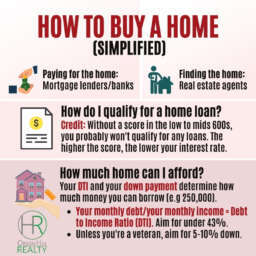

Making an Offer and Closing the Deal

Offering the right price for a rental property requires careful consideration of the property’s value, market conditions, and negotiation strategies. Submitting a competitive offer backed by thorough research and financial preparation can increase your chances of closing the deal successfully.

This stage involves negotiating the terms of the purchase agreement, conducting property inspections, and arranging financing. Working closely with real estate professionals and legal advisors can help you navigate the closing process smoothly and avoid potential pitfalls.

Property Management Strategies

Budgeting for property management involves allocating funds for maintenance, repairs, tenant screening, and emergency expenses. Implementing efficient property management strategies will help you maintain the value of your investment and ensure a positive rental experience for tenants.

Plus, leveraging technology such as property management software and online rental platforms can streamline operations, improve communication with tenants, and optimize your property management processes for increased profitability.

Tips for Successful Rental Property Investing

Many real estate investors find success in the rental property market by following key principles and strategies. It’s crucial to understand the nuances of this type of investment to maximize your returns and minimize risks. Here are some valuable tips to help you succeed in rental property investing:

Property Location and Market Demographics

To ensure your rental property’s success, it’s crucial to choose the right location and understand the market demographics. Location plays a vital role in determining the demand for rental properties and the potential rental income. Conduct thorough research on the neighborhood, amenities, school districts, and proximity to public transportation. Additionally, analyze market demographics such as average household income, population growth, and employment rates to identify the target tenant demographic for your property.

When selecting a location for your rental property, consider factors like job opportunities, population trends, and development projects in the area. Investing in a location with positive growth indicators can lead to higher rental demand and property appreciation over time.

Tenant Screening and Relationships

Tips for successful rental property investing also include establishing effective tenant screening processes and building positive relationships with tenants. Tenant screening is crucial to ensure you are renting to reliable and responsible tenants who will pay rent on time and take care of your property. Conduct background and credit checks, verify employment and income, and check references to assess the tenant’s reliability.

The key to maintaining a successful rental property business is to foster positive relationships with your tenants. Clear communication, prompt responses to maintenance requests, and fair treatment can help establish trust and loyalty with your tenants, leading to longer lease agreements and lower vacancy rates.

Thetenant screening process is a critical component of successful rental property investing. By thoroughly vetting potential tenants, you can reduce the risk of late payments, property damage, and disputes. The key to a successful landlord-tenant relationship lies in clear expectations, open communication, and mutual respect. By treating your tenants with professionalism and addressing their concerns promptly, you can create a positive rental experience for both parties.

Maintenance and Upkeep

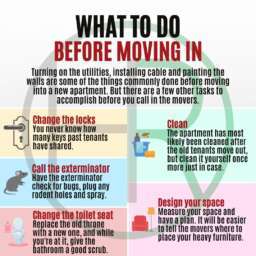

Maintenance is a key aspect of successful rental property investing. Regular maintenance and upkeep not only preserve the value of your property but also keep your tenants satisfied and more likely to renew their lease. Create a maintenance schedule to address repairs and upgrades promptly, and conduct regular inspections to identify any potential issues before they escalate.

For instance, investing in preventive maintenance such as HVAC servicing, roof inspections, and pest control can save you money in the long run by preventing costly repairs and replacements. Additionally, responding to maintenance requests in a timely manner shows your tenants that you value their comfort and well-being, fostering positive landlord-tenant relationships.

Legal Compliance and Tax Implications

Property ownership comes with legal responsibilities and tax implications that rental property investors must understand. Familiarize yourself with landlord-tenant laws, fair housing regulations, and property maintenance requirements to avoid legal issues and potential liabilities. Consult with a real estate attorney or tax professional to ensure you comply with all relevant laws and maximize tax benefits.

Location also plays a crucial role in legal compliance and tax implications for rental property investing. Different states and municipalities have varying regulations and tax laws governing rental properties. Be sure to research and understand the specific requirements in your location to operate your rental property business legally and efficiently.

Analyzing the Investment: Factors, Pros and Cons

For investors looking to venture into real estate by investing in rental properties, it is crucial to carefully analyze various factors before making a decision. Understanding the pros and cons associated with this type of investment can help investors make informed choices and mitigate potential risks.

Factors Influencing Rental Property Investments

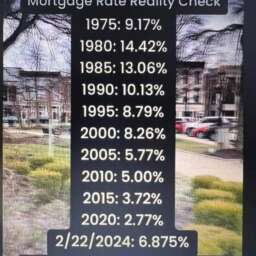

One of the key factors that influence rental property investments is location. Location plays a significant role in determining the demand for rental properties, rental rates, and overall profitability. Other factors include property condition, market trends, financing options, and local regulations.

- Demand: Consider the demand for rental properties in the area before investing.

- Rental Rates: Research the average rental rates in the market to determine potential income.

- Market Trends: Stay updated on market trends that could affect the rental property market.

- Financing Options: Explore various financing options to secure the best deal for your investment.

- Regulations: Familiarize yourself with local regulations and laws that impact rental properties.

Assume that a thorough analysis of these factors is important to make an informed decision about investing in rental properties.

Pros of Investing in Rental Properties

Property appreciation is one of the significant advantages of investing in rental properties. Over time, properties tend to increase in value, providing investors with potential long-term capital gains. Another benefit is the passive income generated from rental payments, which can provide financial stability and security.

Plus, rental properties can serve as a hedge against inflation, as rental income and property values often increase with inflation. This can help investors maintain the value of their investment portfolio and offset the impact of rising prices.

Cons of Investing in Rental Properties

Factors such as vacancy risk, property maintenance costs, and dealing with difficult tenants can pose challenges for rental property investors. Market volatility and economic downturns can also impact rental demand and property values, affecting investors’ returns.

For instance, investing in rental properties requires a significant amount of time and effort to manage the property effectively, especially if you choose to self-manage. Additionally, unexpected expenses such as maintenance or repairs can affect the overall profitability of the investment.

Key Takeaways

Pros of investing in rental properties include property appreciation, passive income, and inflation hedge. This type of investment can provide long-term financial benefits and diversification for investors seeking stable returns.

This investment strategy is not without risks, and investors should carefully consider factors such as vacancy risk, maintenance costs, and market volatility before making investment decisions. Conducting thorough research and due diligence is important to mitigate potential risks and maximize returns.

Long-Term Strategy and Growth Potential

Takeaways from investing in rental properties include long-term wealth accumulation, portfolio diversification, and potential for passive income. Rental properties can be a valuable addition to an investment portfolio for investors looking to build wealth over time.

Potential risks associated with rental property investments should not deter investors from exploring this asset class, but rather prompt them to develop a strategic approach and risk management plan to optimize returns and achieve long-term financial goals.

FAQ

Q: Why should I consider investing in rental properties?

A: Investing in rental properties can provide a steady source of passive income, potential tax benefits, and the opportunity for long-term wealth accumulation through property appreciation.

Q: What are some key factors to consider when investing in rental properties?

A: Some key factors to consider include location, property condition, rental market demand, financing options, property management strategy, and potential return on investment.

Q: How can I effectively manage my rental properties for maximum returns?

A: To maximize returns on your rental properties, consider hiring a reputable property management company, staying updated on market rental rates, conducting regular property maintenance, screening tenants thoroughly, and staying informed on landlord-tenant laws.

Michael Clark

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇