How-To Guide For First-Time Homebuyers – Navigating The Real Estate Market

Embarking on the journey of purchasing your first home can be both exciting and overwhelming, especially for those navigating the complex real estate market for the first time. In this comprehensive guide, we will equip you with vital knowledge and strategies to help you make informed decisions and secure your dream home. From understanding the home buying process to deciphering real estate jargon and negotiating the best deal, we’ve got you covered. Avoid common pitfalls and ensure a smooth homebuying experience with our expert advice.

Key Takeaways:

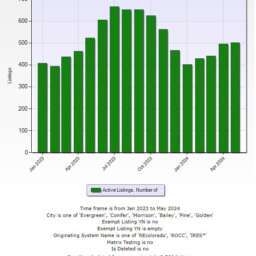

- Research the market: Before stepping into the real estate market, first-time homebuyers should conduct thorough research to understand home values, neighborhood trends, and financing options. This will help in making informed decisions and finding the right property.

- Get pre-approved for a mortgage: It is vital for first-time homebuyers to get pre-approved for a mortgage before starting their home search. This will give them a clear picture of how much they can afford and make the buying process smoother and more efficient.

- Work with a real estate agent: Collaborating with a professional real estate agent can be invaluable for first-time homebuyers. An agent can provide guidance, negotiate on the buyer’s behalf, and help navigate the complexities of the real estate market to ensure a successful home purchase.

Preparing for House Hunting

Assuming you have made the exciting decision to purchase your first home, you are now ready to commence on the house hunting journey. This is an important step that requires careful preparation to ensure a successful homebuying experience. Before you start visiting properties, it is crucial to prepare yourself by setting a realistic budget and identifying key factors that will help you choose the right location for your new home.

Setting a Realistic Budget

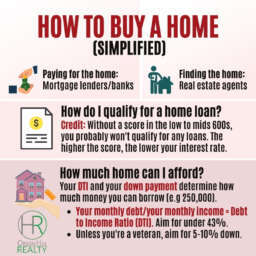

An vital first step in preparing for house hunting is to set a realistic budget. This involves taking a close look at your finances, including your income, expenses, savings, and any additional sources of funding you may have. Knowing your budget will help you narrow down your search and focus on properties that are within your financial means, preventing you from wasting time and energy on homes that are not affordable.

Once you have determined your budget, it is important to factor in additional costs such as closing costs, maintenance expenses, property taxes, and homeowners insurance. Understanding the full financial picture will give you a clear idea of how much you can comfortably afford to spend on a new home without stretching your finances too thin.

Identifying Key Factors in Choosing a Location

Factors such as proximity to work, quality of schools, safety of the neighborhood, access to amenities, and future development plans are all crucial considerations when choosing a location for your new home. Knowing what factors are most important to you will help you narrow down your search and focus on neighborhoods that align with your priorities.

- Proximity to work: Consider how far you are willing to commute on a daily basis.

- School quality: Research the school districts in the areas you are interested in.

- Neighborhood safety: Look into crime rates and overall safety of the area.

- Access to amenities: Evaluate the proximity to grocery stores, parks, restaurants, and other conveniences.

This information will not only help you find a location that meets your needs but will also ensure that you are making a wise investment in a property that is well-suited to your lifestyle and future plans.

Securing Financing

It can be overwhelming for first-time homebuyers to navigate the real estate market, especially when it comes to securing financing. Understanding the various mortgage options available and learning how to make a successful mortgage application are crucial steps in the home buying process.

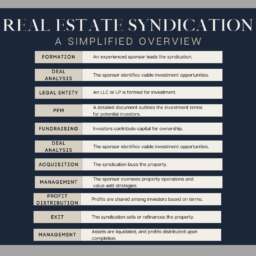

Exploring Mortgage Options

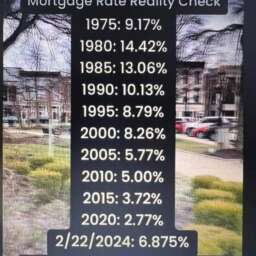

Any first-time homebuyer should explore different mortgage options to find the best fit for their financial situation. Common options include fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, and USDA loans. Each option has its own requirements and benefits, so it’s imperative to compare them carefully before making a decision.

When exploring mortgage options, consider factors such as interest rates, down payment requirements, and loan terms. Working with a knowledgeable loan officer can help you understand the pros and cons of each option and choose the one that aligns with your long-term financial goals.

Tips for a Successful Mortgage Application

To increase your chances of a successful mortgage application, follow these tips:

- Check your credit score before applying for a mortgage.

- Organize all necessary financial documents, such as pay stubs, tax returns, and bank statements.

- Avoid making big purchases or taking on new debt before applying for a mortgage.

Assume that a lender will scrutinize your financial history and make decisions based on your creditworthiness and ability to repay the loan. By following these tips, you can present yourself as a responsible and reliable borrower.

Navigating the Real Estate Market

All first-time homebuyers face the daunting task of navigating the real estate market. It can be overwhelming with the multitude of options, prices, and locations available. However, with the right knowledge and guidance, you can confidently make informed decisions throughout the home buying process.

How to Search for Your Ideal Home

Home searching is a crucial step in the home buying journey. Start by defining your must-haves and deal breakers to narrow down your search criteria. Consider factors such as location, size, amenities, and budget. Utilize online real estate platforms, work with a trusted real estate agent, and attend open houses to get a feel for different neighborhoods and properties.

Once you have a shortlist of potential homes, schedule visits to see them in person. Pay attention to details such as the condition of the property, neighborhood surroundings, and potential for future renovations. Take notes and pictures to help you remember each property and make comparisons later on. Recall, finding your ideal home may take time, so be patient and thorough in your search.

Making an Offer and Negotiating

On the other hand, making an offer and negotiating is a critical aspect of the home buying process that requires strategy and tact. When you find a property you love, your real estate agent can help you determine a competitive offer price based on market analysis and current trends. Your offer should also include contingencies such as financing and home inspection.

To negotiate effectively, remain flexible but firm on your offer terms. Be prepared to counteroffer if the seller rejects your initial proposal. Keep communication lines open with the seller through your agent to facilitate a smooth negotiation process. Recall, the goal is to reach an agreement that is mutually beneficial for both parties.

To make your offer stand out, consider including a personal letter to the seller expressing your interest in the property. This personal touch can sometimes make a difference in a competitive market. Be prepared for multiple rounds of negotiation, and trust your real estate agent’s guidance to help you navigate this process successfully.

Closing the Deal

When you’ve found your dream home and negotiated a price with the seller, you’re one step closer to becoming a homeowner. The final steps in the home buying process involve closing the deal, which includes understanding closing costs and fees, as well as completing the final walkthrough and closing process.

Understanding Closing Costs and Fees

With closing costs and fees, it’s important to be prepared for the expenses that come with finalizing the purchase of your new home. Closing costs typically range from 2% to 5% of the total loan amount and can include fees for appraisal, inspection, title search, attorney fees, and more. It’s crucial to review the Loan Estimate and Closing Disclosure provided by your lender to understand all the costs associated with closing.

The Final Walkthrough and Closing Process

To ensure that the property is in the agreed-upon condition and that any repairs requested have been completed, the final walkthrough is vital. During this process, you should inspect the property, test appliances, check for any damages, and ensure that all agreed-upon fixtures are still in place. Once you are satisfied with the condition of the property, you can proceed with the closing process.

Costs can vary depending on the location and type of property you are purchasing. It is crucial to budget for closing costs and fees in addition to your down payment to avoid any last-minute financial surprises. By understanding the closing costs and fees associated with buying a home, and completing a thorough final walkthrough, you can confidently close the deal on your new home.

Moving Into Your New Home

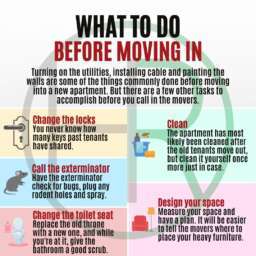

Pre-Move Checklist

Checklist: Before the big moving day, make sure you’ve taken care of all the necessary tasks to ensure a smooth transition into your new home. First, confirm the moving date and schedule with your moving company or helpers. Next, update your address with the post office, banks, credit card companies, and any other imperative accounts. Don’t forget to transfer or set up utilities like electricity, water, gas, internet, and cable services for your new home.

Once you have the logistics in place, start packing early. Organize your belongings room by room and label boxes clearly to make unpacking easier. Declutter and donate items you no longer need or use to lighten your load. Lastly, create a moving day kit with imperatives like snacks, toiletries, important documents, and tools for furniture assembly.

Post-Move Essentials

Essentials: Congratulations on successfully moving into your new home! Now that you’re in, it’s time to focus on settling in and making your space truly yours. Unpack the imperatives first, such as bedding, kitchenware, and toiletries, to make your first night comfortable. Set up your beds and key furniture pieces to create a sense of home right away.

Once you’ve unpacked the basics, take some time to explore your new neighborhood and locate imperative services like grocery stores, pharmacies, and healthcare facilities. Additionally, update your driver’s license and car registration with your new address to avoid any legal issues. Keep in mind, patience is key during this transition period as you adjust to your new surroundings and create new routines.

Moving: Moving into your new home is a significant milestone, and proper planning and organization can make the process easier and less stressful. Remember to stay focused on the tasks at hand and delegate responsibilities when needed. Celebrate this new chapter in your life and embrace the opportunities that come with owning your own home!

Final Words

So, as a first-time homebuyer navigating the complexities of the real estate market, it is vital to arm yourself with knowledge and be prepared for the journey ahead. By following this comprehensive guide, you can confidently approach the homebuying process, make informed decisions, and ultimately find the perfect home for you. Remember to stay patient, ask questions, and seek guidance from experienced professionals to ensure a successful homebuying experience. With determination and thorough research, you will be well-equipped to make one of the most significant investments of your life. Good luck on your journey to becoming a homeowner!

FAQ

Q: What Should First-Time Homebuyers Consider Before Purchasing a Property?

A: First-time homebuyers should consider factors such as their budget, location preferences, desired amenities, and long-term financial goals before purchasing a property. It’s important to conduct thorough research, get pre-approved for a mortgage, and work with a reliable real estate agent to navigate the market effectively.

Q: What Steps Should First-Time Homebuyers Take During the Homebuying Process?

A: First-time homebuyers should start by identifying their needs and preferences, creating a budget, and exploring different financing options. They should attend open houses, conduct home inspections, and negotiate offers with the help of their real estate agent. It’s necessary to carefully review contracts and seek professional guidance to ensure a smooth transaction.

Q: How Can First-Time Homebuyers Avoid Common Pitfalls in the Real Estate Market?

A: First-time homebuyers can avoid common pitfalls by staying within their budget, not rushing into a decision, and conducting thorough inspections of potential properties. It’s important to be aware of additional costs such as closing fees and maintenance expenses. Seeking guidance from experienced professionals and educating oneself about the market can help navigate potential challenges effectively.

David Clark

It's Nice to Share

Comment, Write a Blog Post, Create Groups, Get Seen!

Comments, Opinions and Facts Go Here...👇